👨🏼🍼 Financial Inclusion

Learn basics of Financial Inclusion

Financial Inclusion

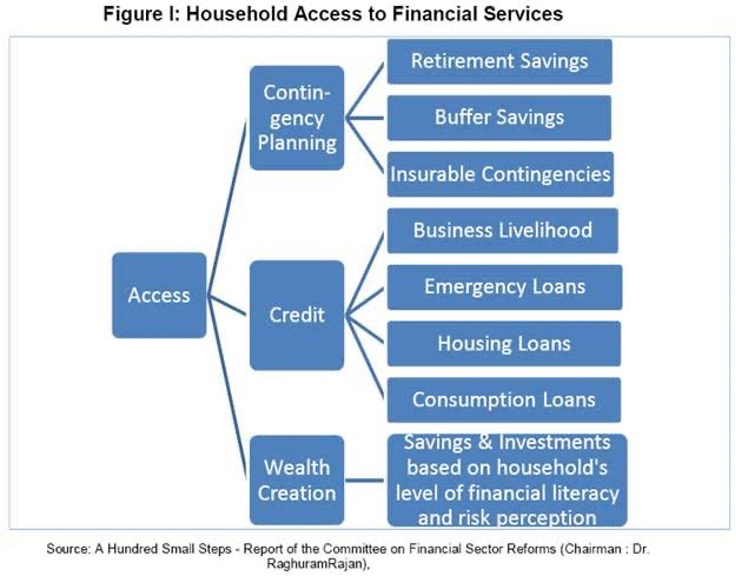

- Financial inclusion may be defined as the process of ensuring access to financial services and timely and adequate credit where needed by vulnerable groups such as weaker sections and low-income groups at an affordable cost (The Committee on Financial Inclusion, Chairman: Dr. C. Rangarajan).

- The essence of financial inclusion is to ensure delivery of financial services which include - bank accounts for savings and transactional purposes, low cost credit for productive, personal and other purposes, financial advisory services, insurance facilities (life and non-life) etc.

Why Financial Inclusion?

- Financial inclusion broadens the resource base of the financial system by developing a culture of savings among large segment of rural population and plays its own role in the process of economic development.

- Further, by bringing low income groups within the perimeter of formal banking sector; financial inclusion protects their financial wealth and other resources in exigent circumstances.

- Financial inclusion also mitigates the exploitation of vulnerable sections by the usurious money lenders by facilitating easy access to formal credit.

NABARD All India Financial Inclusion Survey (NAFIS)

- NABARD All India Financial Inclusion Survey (NAFIS), conducted by National Bank for Agriculture and Rural Development (NABARD), revealed that farm households register higher income than the families solely dependent on non-farm livelihood activities in rural areas.

- The survey, with reference year of

2015-16, which covered 40,327 rural households, highlighted that the average annual income of an agricultural household isRs 1,07,172compared toRs 87,228for families engaged only in non-agricultural activities. - The survey defined farm households as families having over Rs 5,000 as value of produce from agricultural operations in the year preceding the survey. For all rural households, the average annual income stood at

Rs 96,708. - Agricultural households earned 34% of their income from cultivation. Wage earnings contributed the same proportion to the income followed by salaries (16%), livestock (8%) and non-farm sector (6%). Other sources accounted for the rest.

- Non-agricultural households reported average annual income of Rs 87,228 majorly contributed by wages (54%), followed by salaries (32%) and non-farm sector activities (12%). Agricultural households earned 23% more than non-agricultural households.

- The

48 percentof the rural families are agricultural households. - Apart from assessing the income levels of rural households, the survey mapped aspects like debt, saving, investment, insurance, pension and financial aptitude and behaviour of individuals.

- Incidence of Indebtedness (IOI), which is a proportion of households having outstanding debt on the date of the survey, was

52.5 percentand42.8 percentfor agricultural and non-agricultural households respectively. All India IOI taking rural households together stood at47.4 per cent. - Average amount of outstanding debt (AOD) for indebted agricultural households is reportedly

Rs 1,04,602as on the date of the survey. Debt outstanding for indebted non-agricultural households is reportedly Rs 76,731. Overall extent of indebtedness taking all households combined is Rs 91,407. - While

88.1 per centrural households and 55 percent agricultural households reported having a bank account, average savings per annum per household wasRs 17,488. - About

26 percentof agricultural households and25 percentof non-agricultural households were found to have been covered under insurance. - Similarly,

20.1 percentagricultural households as against18.9 percentnon-agricultural households have subscribed to pension schemes. - Notably, the survey was conducted on a pan-India basis drawing samples from as many as 2016 villages in 245 districts and 29 states. A population of 1,87,518 was covered in the process. The data was collected through the paperless method of Computer Aided Personal Interview. The survey was commissioned in 2016.

Pradhan Mantri Mudra Yojana (PMMY)

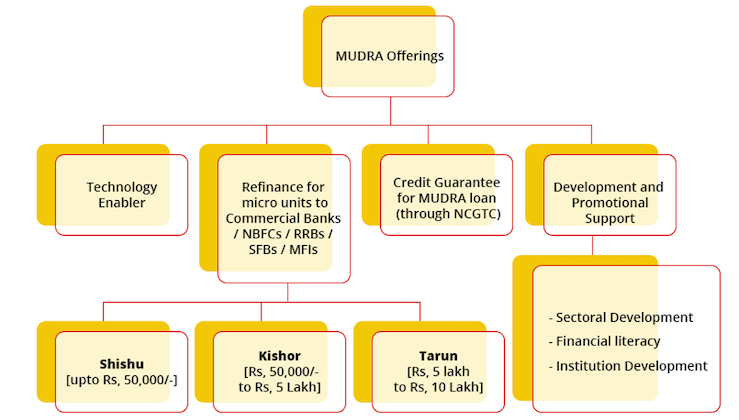

- It is a flagship scheme of Government of India to “fund the unfunded” by bringing such enterprises to the formal financial system and extending affordable credit to

non-corporate,non-farmsmall/micro enterprises. - Mudra loan is extended for a variety of purposes which provides income generation and employment creation in Manufacturing, Services, Retail and Agri. Allied Activities.

- It enables a small borrower to borrow from all Public Sector Banks such as Commercial Banks, Regional Rural Banks, Small Finance Banks, Micro Finance Institutions (MFI) and Non-Banking Finance Companies (NBFC) for loans upto Rs 10 lakhs for non-farm income generating activities.

MUDRAis a refinancing Institution. MUDRA does not lend directly to the micro entrepreneurs / individuals. Mudra loans under Pradhan Mantri Mudra Yojana (PMMY) can be availed of from nearby branch office of a bank, NBFC, MFIs etc.- Borrowers can also now file online application for MUDRA loans on Udyamimitra portal (www.udyamimitra.in).

- The scheme was launched on 8th April,

2015by the Hon’ble Prime Minister. - MUDRA has been initially formed as a wholly owned subsidiary of

Small Industries Development bank of India (SIDBI)with 100% capital being contributed by it.

Implementation

- The government proposes to set up a

Micro Units Development and Refinance Agency (MUDRA)NABARD 2019 Bank through a statutory enactment. - This Bank would be responsible for regulating and refinancing all Micro-finance Institutions (MFI) which are in the business of lending to micro/small business entities engaged in manufacturing, trading and services activities.

- The Bank would partner with state level/regional level co-ordinators to provide finance to Last Mile Financer of small/micro business enterprises.

Eligibility

- Any Indian Citizen who has a business plan for a non-farm sector income generating activity such as manufacturing, processing, trading or service sector and whose credit need is less than Rs 10 lakh can approach either a Bank, MFI, or NBFC for availing of Micro Units Development & Refinance Agency Ltd. (MUDRA) loans under PMMY.

- Budget 2019-20: “For every verified women SHG member having a Jan-Dhan Bank Account, an overdraft of Rs 5,000 shall be allowed. One woman in every SHG will also be made eligible for a loan up to

Rs 1 lakhunder the MUDRA scheme”. - Types of loans provided

- Shishu: covering loans upto

Rs. 50,000/- - Kishor: covering loans above

Rs. 50,000/- and upto 5 lakh - Tarun: covering loans above

Rs. 5 lakh and upto 10 lakh

- Shishu: covering loans upto

- The interventions have been named ‘Shishu’, ‘Kishor’ and ‘Tarun’ to signify the stage of growth / development and funding needs of the beneficiary micro unit / entrepreneur and also provide a reference point for the next phase of graduation / growth to look forward to.

- It would be ensured that at least 60% of the credit flows to Shishu Category Units and the balance to Kishor and Tarun Categories.

- There is no subsidy for the loan given under PMMY. However, if the loan proposal is linked some Government scheme, wherein the Government is providing capital subsidy, it will be eligible under PMMY also.

- Note: For all PMMY loans, the following are to be noted.

- No processing fees

- No collateral

- Repayment period of loan is extended up to 5 years

- Applicant should not be defaulter of any Bank / Financial Institution

Pradhan Mantri Jan Dhan Yojana

- With a view to increase banking penetration, promote financial inclusion and to provide at least one bank account per household across the country, a National Mission on Financial Inclusion known as Pradhan Mantri Jan Dhan Yojana (PMJDY) was announced by the Prime Minister Shri Narendra Modi in his Independence Day Speech on

15th August, 2014.

Objectives

- To bring poor financially excluded people into banking system.

- It covers both urban and rural areas.

- To decrease corruption in govt. subsidy schemes (DBT)

- Digital India

- Raise Indian economy.

Salient features of the scheme

- All households across the country - both rural and urban are to be covered under the scheme. Bank accounts will be opened for poor people. The bank accounts are Basic Saving Deposit Bank Account (BSBD) with additional features.

- All bank accounts opened under the scheme are to have an overdraft facility of Rs 10,000 for Aadhar-linked accounts after satisfactory operation in the account for 6 months.

- Issuance of RuPay Debit Card with inbuilt Rs 1 lakh personal accident insurance cover provided by HDFC Ergo and a life cover of Rs 30,000 provided by LIC.

- A minimum monthly remuneration of Rs 5,000 to business correspondents who will provide the last link between the account holders and the bank.

Implementation of the scheme

The mission will be implemented in two phases, the details of which are as follows.

👉🏻 Phase I - 15 August 2014 - 14 August 2015

- Universal access to banking facilities for all households across the country through a bank branch or a fixed-point Business Correspondent (BC) within a reasonable distance.

- To cover all households with at least one basic banking account with RuPay Debit Card with inbuilt Rs 1 lakh accident insurance cover.

- Financial literacy programme to be taken to the village level.

- Expansion of Direct Benefit Transfer under various government schemes through bank accounts of the beneficiaries.

- Issuance of Kisan Credit Card is also proposed

👉🏻 Phase II - 15 August 2015 - 14 August 2018

- Providing micro-insurance to the people.

- Unorganized sector pension schemes like Swavalamban through the Business Correspondents.

👉🏻 Phase III - beyond 14 August 2018

- National Mission for Financial Inclusion as PMJDY beyond 14.8.2018

- Focus on opening accounts from “Every Household to Every Adult”.

- Existing Over Draft limit of Rs 5,000 raised to

Rs 10,000. - No conditions for Overdraft upto

Rs 2,000. - Age limit for availing Over Draft facility revised from 18-60 years to

18-65 years. - Expanded accidental insurance cover for new RuPay card holders raised from Rs 1 lakh to Rs 2 lakh for new PMJDY accounts opened after 28.8.18.

Impact

- The continuation of the Mission would enable all adults/households of the country to have at least a basic bank account with access to other financial services, social security schemes and overdraft up to Rs. 10,000.

- It will, thus, bring them into the mainstream of financial services and will facilitate transfer of benefits of various subsidy schemes of the Government more efficiently.

Achievements under PMJDY

- Approx. 40 crore Jan Dhan accounts (Nov. 2019) have been opened with more than crossed Rs 1.30 Lakh crore of deposit balance.

- 53% women Jan Dhan account holders and 59% Jan Dhan accounts are in rural and semi urban areas.

- The government, as part of Pradhan Mantri Garib Kalyan Yojana, remitted ₹1,500 per account in three equal monthly installments to support the poor during the COVID-19 crisis.

Financial Inclusion

- Financial inclusion may be defined as the process of ensuring access to financial services and timely and adequate credit where needed by vulnerable groups such as weaker sections and low-income groups at an affordable cost (The Committee on Financial Inclusion, Chairman: Dr. C. Rangarajan).

- The essence of financial inclusion is to ensure delivery of financial services which include - bank accounts for savings and transactional purposes, low cost credit for productive, personal and other purposes, financial advisory services, insurance facilities (life and non-life) etc.

Why Financial Inclusion?

- Financial inclusion broadens the resource base of the financial system by developing a culture of savings among large segment of rural population and plays its own role in …

Become Successful With AgriDots

Learn the essential skills for getting a seat in the Exam with

🦄 You are a pro member!

Only use this page if purchasing a gift or enterprise account

Plan

Rs

- Unlimited access to PRO courses

- Quizzes with hand-picked meme prizes

- Invite to private Discord chat

- Free Sticker emailed

Lifetime

Rs

1,499

once

- All PRO-tier benefits

- Single payment, lifetime access

- 4,200 bonus xp points

- Next Level

T-shirt shipped worldwide

Yo! You just found a 20% discount using 👉 EASTEREGG

High-quality fitted cotton shirt produced by Next Level Apparel