🪜 Incomes Support Schemes

Learn abut PM-KISAN, PM-KMDY, PM-AASHA, PM-KUSUM, Kisan Vikas Patra, SMAM etc. income support schemes.

PM-KISAN

- Pradhan Mantri Kisan Samman Nidhi

- To provide an assured income support to the small and marginal farmers, the Government is launching the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN).

- It is a Central Sector scheme with 100% funding from Government of India.

- The Scheme is effective from 1.12.

2018. - The key element of PM-KISAN is income support of

Rs. 6000/- per yearto the small and marginal landholder farmer families with cultivable land holding upto 2 hectare across the country. (This has been expanded to all farmers irrespective of land holding) AFO-2021 - The amount is being released in three 4-monthly instalments of

Rs. 2000/- eachover the year, to be credited into the bank accounts of the beneficiaries held in destination banks through Direct Benefit Transfer mode. - Department of Agriculture, Cooperation & Farmers Welfare, Ministry of Agriculture & Farmers Welfare.

- Definition of family for the Scheme is husband, wife and minor children.

- The entire responsibility of identification of beneficiary farmer families rests with the State / UT Governments.

- The fund is directly transferred to the bank accounts of the beneficiaries.

- Farmers covered under the Exclusion Criteria of the Operational Guidelines are not eligible for the benefit of the Scheme.

Revised Scheme

- PM-KISAN Scheme extension to include all eligible farmer families irrespective of the size of land holdings.

- The revised Scheme is expected to cover around 2 crore more farmers, increasing the coverage of PM-KISAN to around

14.5 crorebeneficiaries, with an estimated expenditure by Central Government of Rs. 87,217.50 crores for year 2019-20. - State wise beneficiaries (29/12/2019)

UP(1.97 crore) > MH (81 lakh) > RJ (56 lakh)- Lakshadweep & WB = 0

- Total = 8.62 Crore

- GoI had launched a drive to saturate all eligible farmers of the country under KCC. To facilitate this all charges including processing, documentation, inspection and ledger folio charges as well as other service charges for KCC loans upto Rs 3 lakhs have been waived off by Indian Banks’ Association (IBA).

- Banks have been instructed to issue KCC within 14 days (2 weeks) of receipt of completed application from farmers.

- All the PM-KISAN beneficiaries are to be requested to approach the bank branch where they have PM-KISAN account, for availing benefit of KCC for accessing concessional Institutional Credit during this period. All PM-KISAN beneficiaries who already have existing KCC can approach their bank branch for enhancement of limit if required.

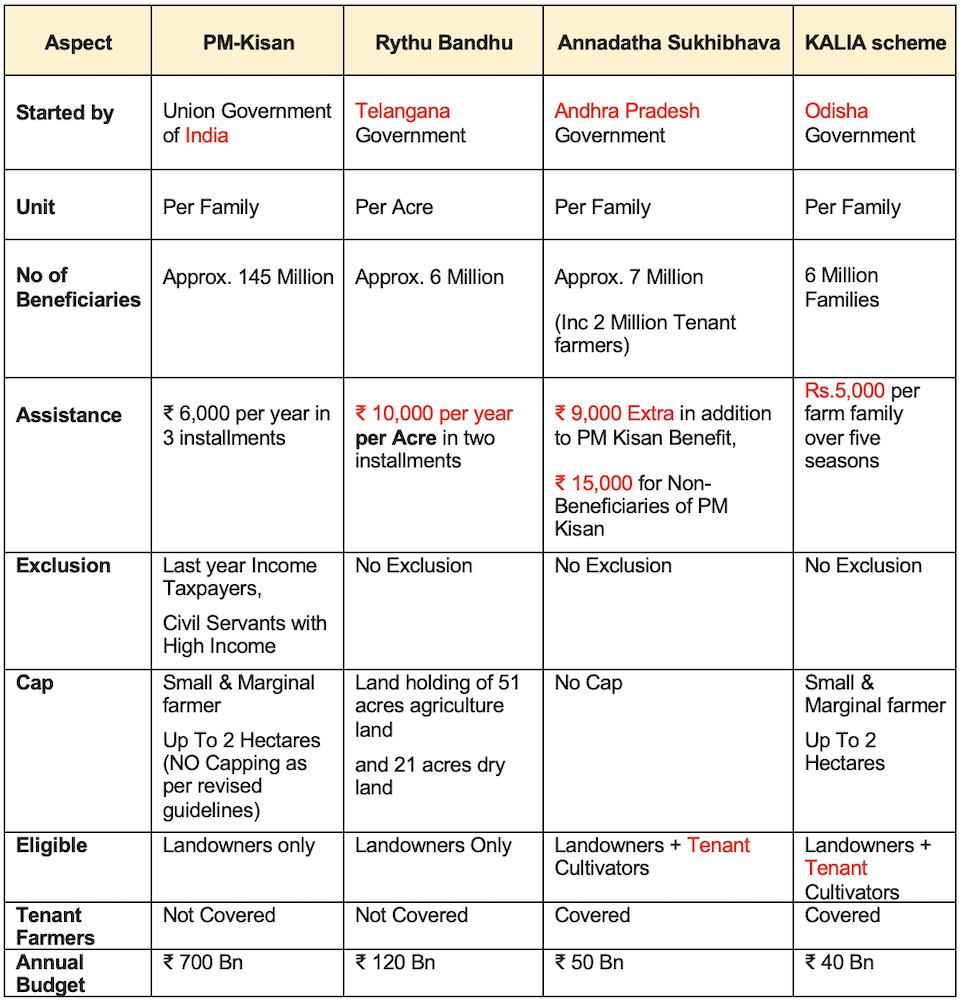

Comparison with similar schemes

PM-KMDY

- Pradhan Mantri Kisan Maan-Dhan Yojana.

- It is an old age pension scheme for all land holding Small and Marginal Farmers (SMFs) in the country. It is a voluntary and contributory pension scheme for the entry age group of

18 to 40 years. The Scheme is effective from the 9th August,2019.

Eligibility

- Small and Marginal Farmer (SMF) - a farmer who owns cultivable land

up to 2 hectareas per land records of the concerned State/UT. - Age of

18- 40 yearsPradhan Mantri Kisan Maan-Dhan Yojana (PM-KMY) is an old age pension scheme for Small and Marginal Farmers (SMFs) in the country.

Salient features

- It is voluntary and contributory for farmers in the entry age group of 18 to 40 years and a monthly pension of

Rs. 3000/-will be provided to them on attaining the age of60 years. - The farmers will have to make a monthly contribution of

Rs. 55 to Rs. 200, depending on their age of entry, in the Pension Fund till they reach the retirement date i.e. the age of 60 years. The farmers will have to make a monthly contribution of Rs. 55 to Rs. 200, depending on their age of entry, in the Pension Fund till they reach the retirement date i.e. the age of 60 years. - The monthly contributions will fall due on the same day every month as enrolment date. The beneficiaries may also choose an option to pay their contributions on quarterly, 4-monthly or half-yearly basis. Such contributions will fall due on the same day of such period as the date of enrollment.

- The spouse is also eligible to get a separate pension of Rs. 3000/- upon making separate contributions to the Fund.

- The Life Insurance Corporation of India (LIC) shall be the Pension Fund Manager and responsible for Pension pay out.

- In case of death of the farmer before retirement date, the spouse may continue in the scheme by paying the remaining contributions till the remaining age of the deceased farmer. If the spouse does not wish to continue, the total contribution made by the farmer along with interest will be paid to the spouse. If there is no spouse, then total contribution along with interest will be paid to the nominee.

- If the farmer dies after the retirement date, the spouse will receive 50% of the pension as Family Pension. After the death of both the farmer and the spouse, the accumulated corpus shall be credited back to the Pension Fund.

- The beneficiaries may opt voluntarily to exit the Scheme after a minimum period of 5 years of regular contributions. On exit, their entire contribution shall be returned by LIC with an interest equivalent to prevailing saving bank rates.

- The farmers, who are also beneficiaries of PM-Kisan Scheme, will have the option to allow their contribution debited from the benefit of that Scheme directly.

- In case of default in making regular contributions, the beneficiaries are allowed to regularize the contributions by paying the outstanding dues along with prescribed interest. Until 1 month from first unpaid contribution, no late fee would be charged. Three payment cycles demand would be raised for payment of contribution without any interest.

PM-AASHA

- Pradhan Mantri Annadata Aay Sanrakshan Abhiyan

- It is a new umbrella scheme that has been approved by the Union Cabinet in September,

2018. It comprises of the following:- Price Support Scheme (PSS)

- Price Deficiency Payment Scheme (PDPS)

- Pilot of Private Procurement & Stockiest Scheme (PPPS)

- Aim: Ensuring remunerative prices to the farmers for their produce.

- Background: The Government in Budget 2018-19 had increased MSP by following the principle of 1.5 times (minimum of 50% as margin of profit) of the all India weighted average Cost of Production (CoP). It is expected that the increase in MSP will be translated to farmer’s income by way of robust procurement mechanism in coordination with the State Governments.

Sub-schemes under PM-AASHA

- Price Support Scheme: It will become operational when prices of pulses, oilseeds and copra fall below MSP, with the centre bearing procurement expenditure and losses up to 25% of the production. Physical procurement of pulses, oilseeds and Copra will be done by Central Nodal Agencies (NAFED) with proactive role of State governments.

- Price Deficiency Payment Scheme: It will be available only for oilseeds with registered farmers directly receiving payments in their bank accounts when they sell at prices lower than MSP. The government will not undertake physical procurement of crops under this scheme.

- Pilot of Private Procurement & Stockiest Scheme: Participation of private sector in procurement operation would be piloted so that on the basis of learnings the ambit of private participation in procurement operations may be increased.

PM KUSUM

- Recently, the Ministry of New and Renewable Energy (MNRE) has launched

Kisan Urja Suraksha evam Utthaan Mahabhiyan. - KUSUM with the objective of providing financial and water security to farmers.

- This scheme has three components which include 10,000 MW of decentralized ground-mounted, grid-connected renewable power plants; installation of 17.50 lakh standalone solar-powered agriculture pumps and solarisation of 10 lakh grid-connected solar powered agriculture pumps.

- The 3 components of scheme aims to add a solar capacity of 25,750 MW by 2022.

- 20 lakh farmers would be provided funds to set up standalone solar pumps and 15 lakh farmers grid connected.

Component A

- Renewable power projects of capacity 500 kW to 2 MW will be setup by individual farmers/ group of farmers/ cooperatives/ panchayats/ Farmer Producer Organisations (FPO) on baren land. In the above specified entities are not able to arrange equity required for setting up the REPP, they can opt for developing the REPP through developer(s) or even through local DISCOM, which will be considered as RPG in this case.

- DISCOMs will notify sub-station wise surplus capacity which can be fed from such RE power plants to the Grid and shall invite applications from interested beneficiaries for setting up the renewable energy plants.

- The renewable power generated will be purchased by DISCOMs at a feed-in-tariff (FiT) determined by respective State Electricity Regulatory Commission (SERC).

- DISCOM would be eligible to get PBI @ Rs. 0.40 per unit purchased or Rs. 6.6 lakh per MW of capacity installed, whichever is less, for a period of five years from the COD.

Component B

- Individual farmers will be supported to install standalone solar Agriculture pumps of capacity

up to 7.5 HP. (60% Subsidy) - CFA of 30% of the benchmark cost or the tender cost, whichever is lower, of the stand-alone solar Agriculture pump will be provided. The State Government will give a subsidy of 30%; and the remaining 40% will be provided by the farmer. Bank finance may be made available for farmer’s contribution, so that farmer has to initially pay only 10% of the cost and remaining up to 30% of the cost as loan.

- In North Eastern States, Sikkim, Jammu & Kashmir, Himachal Pradesh and Uttarakhand, Lakshadweep and A&N Islands, CFA of 50% of the benchmark cost or the tender cost, whichever is lower, of the stand-alone solar pump will be provided. The State Government will give a subsidy of 30%; and the remaining 20% will be provided by the farmer. Bank finance may be made available for farmer’s contribution, so that farmer has to initially pay only 10% of the cost and remaining up to 10% of the cost as loan. (80% subsidy)

Component C

- Individual farmers having grid connected agriculture pump will be supported to solarise pumps. Solar PV capacity up to two times of pump capacity in kW is allowed under the scheme.

- The farmer will be able to use the generated solar power to meet the irrigation needs and the excess solar power will be sold to DISCOMs. CFA of 30% of the benchmark cost or the tender cost, whichever is lower, of the solar PV component will be provided. The State Government will give a subsidy of 30%; and the remaining 40% will be provided by the farmer. Bank finance may be made available for farmer’s contribution, so that farmer has to initially pay only 10% of the cost and remaining up to 30% of the cost as loan.

- In North Eastern States, Sikkim, Jammu & Kashmir, Himachal Pradesh and Uttarakhand, Lakshadweep and A&N Islands, CFA of 50% of the benchmark cost or the tender cost, whichever is lower, of the solar PV component will be provided. The State Government will give a subsidy of 30%; and the remaining 20% will be provided by the farmer. Bank finance may be made available for farmer’s contribution, so that farmer has to initially pay only 10% of the cost and remaining up to 10% of the cost as loan.

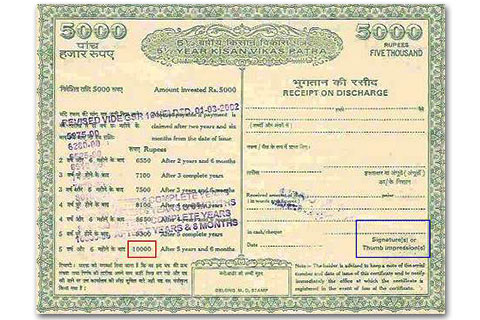

Kisan Vikas Patra (KVP)

- Kisan Vikas Patra is a saving certificate scheme which was first launched in 1988 by India Post. It was successful in the early months but afterwards the Government of India set up a committee under supervision of Shyamala Gopinath which gave its recommendation to the Government that KVP could be misused. Hence the Government of India decided to close this scheme and KVP was closed in 2011 and the new government re-launched it in

2014. - Kisan Vikas Patra can be purchased by:

- An adult in his own name, or on behalf of a minor

- A Trust

- Two adults jointly

- KVP certificates are available in the denominations of Rs 1000, Rs 5000, Rs 10000 and Rs 50000. The minimum amount that can be invested is

Rs 1000. However, there is no upper limit on the purchase of KVPs. - Kisan Vikas Patra does not offer any income tax benefits to the investor. No deduction u/s 80C is allowed on investment and the interest received upon maturity/withdrawal is fully taxable. However, withdrawals are exempted from Tax Deduction at Source (TDS) upon maturity.

- The amount (Principal) invested in Kisan Vikas Patra would get doubled in 124 months (10 years & 04 months) as per existing rate of interest. The rate of interest was slashed to

6.9%RRB-SO & AFO-2021 with effect from 1 April 2020 to 31st March 2021. - The amount of KVP can be withdrawn after 124 months (10 years and 04 months). The maturity period of a KVP is 2 years 6 months (30 months).

- Premature encashment of the KVP certificate is not permissible. The certificates can only be encashed in event of the death of the holder or forfeiture by a pledge or on the order of the courts.

Sub-mission in Agricultural Mechanization (SMAM)

- Launched in year

2014(Revised 2016-17) - During 12th five-year plan

- Fund share:

- 60 : 40 between center and state

- 90 : 10 for states of Northern-Eastern and Himalayan region

- Aim: The scheme implemented in all the states, to promote the usages of mechanization and increased the ratio of farm power to cultivable unit area up to

2 Kw/ha.

PM-KISAN

- Pradhan Mantri Kisan Samman Nidhi

- To provide an assured income support to the small and marginal farmers, the Government is launching the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN).

- It is a Central Sector scheme with 100% funding from Government of India.

- The Scheme is effective from 1.12.

2018. - The key element of PM-KISAN is income support of

Rs. 6000/- per yearto the small and marginal landholder farmer families with cultivable land holding upto 2 hectare across the country. (This has been expanded to all farmers irrespective of land holding) AFO-2021 - The amount is being released in three 4-monthly instalments of

Rs. 2000/- eachover the year, to be credited into the bank accounts of the beneficiaries held in destination banks through Direct Benefit Transfer mode. - Department …

Become Successful With AgriDots

Learn the essential skills for getting a seat in the Exam with

🦄 You are a pro member!

Only use this page if purchasing a gift or enterprise account

Plan

Rs

- Unlimited access to PRO courses

- Quizzes with hand-picked meme prizes

- Invite to private Discord chat

- Free Sticker emailed

Lifetime

Rs

1,499

once

- All PRO-tier benefits

- Single payment, lifetime access

- 4,200 bonus xp points

- Next Level

T-shirt shipped worldwide

Yo! You just found a 20% discount using 👉 EASTEREGG

High-quality fitted cotton shirt produced by Next Level Apparel