👨🏼💼 Insurance Schemes

Learn abuot CCIS, NAIS, MNAIS, PMFBY, RWBCIS, UPI, CPI, LIS etc. insurance schemes.

History

- In

1970, an Expert Committee on crop insurance under the Chairmanship of Dharamnarain was appointed by the Government of India to examine and analyses administrative and financial implications of the scheme with a view to introduce it. In his report he ruled out the possibility of implementing the scheme in India. - Prof Dhandekar strongly defended the implementation of the scheme.

- In 1973, the Government of India has set up General insurance Corpotation (GIC) to carry out all types of insurance business throughout the nation with four subsidiarity insurance companies.

- GIC first introduced the crop insurance scheme in 1973 on experimental basis on pilot scheme in selected centers of Gujarat. Only

H4 cottonwas considered for implementation of the scheme. Later the same was extended to West Bengal, Tamil Nadu and Andhra Pradesh for cotton crop and the scheme was operational till 1979 except the year 1977. - Area based crop insurance scheme was subsequently introduced from 1979 by GIC on a pilot basis in selected areas. If the actual average yield of the crop in the selected area was less than the guaranteed yield of the crop, then the indemnity would become payable to all the insured farmer-borrowers. Sum assured was 100 per cent of the crop loan but celing was imposed with regard to payment of indeminity, i.e. Rs 5000 per farmer-borrower in the case of dryland and Rs 10,000 per farmer-borrower in the case of irrigated areas. This scheme was implemented by 12 states in India up to 1984.

Comprehensive Crop Insurance Scheme (CCIS)

- In

1985, Comprehensive Crop Insurance Scheme (CCIS) was introduced by GIC in all the states based on area approach. - The scheme covers all the farmers availing crop loans and it is limited to cereals such as rice and wheat, millets, oilseeds and pulses. Two percent of the sum insured is fixed premium for rice, wheat and millets, whereas for the oilseeds and pulses it is one percent.

- Sum insured is 150 per cent of the crop lean.

- Indemnity is calculated based on the following formula:

Indemnity = (Shortfall in the yield of the Crop)/(Threshold yield of the Crop ) × Sum Insured

- Eighty per cent of the average annual yield of the crop in a given area (block level) over the last previous five years is considered threshold yield in that area.

- Shortfall in the yield of the crop is the difference between threshold yield of the crop and actual yield of the crop in a particular area in the year under reference. The scheme is applicable only to farmer-borrower. (loanee)

- Both actual and average yield will be studied by

crop-cutting experiments.

National Agricultural Insurance Scheme (NAIS)

- Also called Rastriya Krishi Bima Yojana (RKBY).

- First started in Rabi

1999-2000. - Implemented based in Area approach.

- Implemented by GIC.

- Agriculture Insurance Company (AIC) commenced its business operations from

1 April 2003by taking over the implementation of the “National Agricultural Insurance Scheme” (NAIS) from GIC. AIC has been designated by the Govt of India as the “Implementing Agency” of NAIS, its country-wide crop insurance program.

- Compulsory for loanee and optional for non-loanee farmers.

- Under NAIS, the sum assured as indemnity can go up to 150% of the average yield value.

- Premium and claims were distributed between Centre and State governments in the ratio of 50:50.

- Both actual yield and average yield will be studied based on crop cutting experiments or small area crop estimation method.

Modified National Agricultural Insurance Scheme (MNAIS)

- Launched in

2010-11

Pradhan Mantri Fasal Bima Yojana (PMFBY)

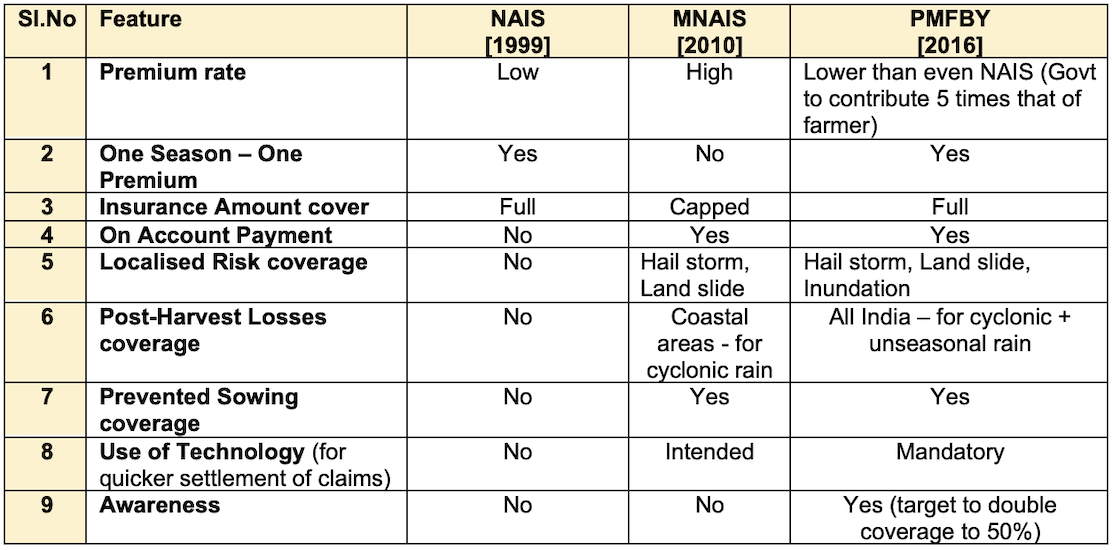

- The new Crop Insurance Scheme is in line with One Nation – One Scheme theme. It incorporates the best features of all previous schemes and at the same time, all previous shortcomings / weaknesses have been removed. The PMFBY will replace the existing two schemes National Agricultural Insurance Scheme as well as the Modified NAIS.

- Launched by Prime Minister of India Narendra Modi in

Kharif 2016. - Aim: providing maximum benefits to farmers for minimum premium.

- Target of bringing around 50% of the cultivated land under the scheme.

- Area under PMFBY has increased to 30% of gross cropped area. (2019-20)

- State govt./UT should provide 10 years’ historical yield data in soft format for calculation of threshold yield, premium rates etc.

Objectives

- To provide insurance coverage and financial support to the farmers in the event of failure of any of the notified crop as a result of natural calamities, pests & diseases.

- To stabilise the income of farmers to ensure their continuance in farming.

- To encourage farmers to adopt innovative and modern agricultural practices.

- To ensure flow of credit to the agriculture sector.

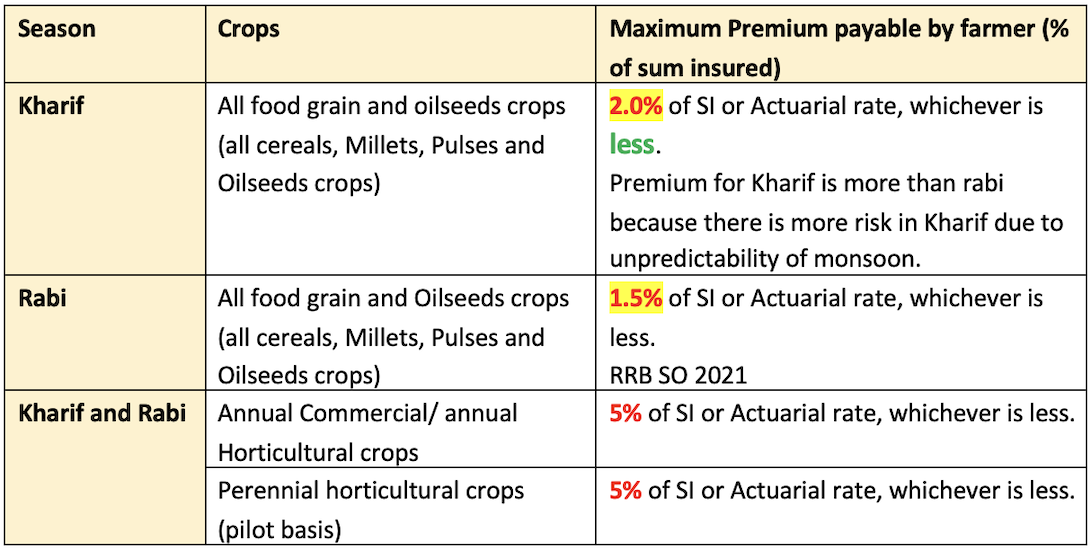

⭐️ Premium Rates

👉🏻 RRB SO 2021, AFO, NABARD

Highlights of the scheme

- There will be a uniform premium of only

2.0 %to be paid by farmers for all Kharif crops and1.5 %for all Rabi crops. In case of annual commercial and horticultural crops, the premium to be paid by farmers will be only5.0 %. The premium rates to be paid by farmers are very low and balance premium will be paid by the Government to provide full insured amount to the farmers against crop loss on account of natural calamities. - There is no upper limit on Government subsidy. Even if balance premium is 90%, it will be borne by the Government.

- Earlier, there was a provision of capping the premium rate which resulted in low claims being paid to farmers. This capping was done to limit- Government outgo on the premium subsidy. This capping has now been removed and farmers will get claim against full sum insured without any reduction.

- The use of technology will be encouraged to a great extent. Smart phones will be used to capture and upload data of crop cutting to reduce the delays in claim payment to farmers. Remote sensing will be used to reduce the number of crops cutting experiments.

- PMFBY is a replacement scheme of NAIS / MNAIS, there will be exemption from Service Tax liability of all the services involved in the implementation of the scheme. It is estimated that the new scheme will ensure about 75-80 per cent of subsidy for the farmers in insurance premium.

Farmers to be Covered

- All farmers growing notified crops in a notified area during the season who have insurable interest in the crop are eligible.

- To address the demand of farmers, the scheme has been made

voluntaryfor all farmers from Kharif 2020. - Earlier to Kharif 2020, the enrollment under the scheme was compulsory for following categories of farmers:

- Farmers in the notified area who possess a Crop Loan account/KCC account (called as Loanee Farmers) to whom credit limit is sanctioned/renewed for the notified crop during the crop season.

- Such other farmers whom the Government may decide to include from time to time.

Unit of Insurance

- The Scheme shall be implemented on an ‘

Area Approach basis’ i.e., Defined Areas for each notified crop for widespread calamities with the assumption that all the insured farmers, in a Unit of Insurance, to be defined as “Notified Area” for a crop, face similar risk exposures, incur to a large extent, identical cost of production per hectare, earn comparable farm income per hectare, and experience similar extent of crop loss due to the operation of an insured peril, in the notified area. - Defined Area (i.e., unit area of insurance) is Village/Village Panchayat level by whatsoever name these areas may be called for major crops and for other crops it may be a unit of size above the level of Village/Village Panchayat. In due course of time, the Unit of Insurance can be a- Geo-Fenced/Geo-mapped region having homogenous Risk Profile for the notified crop.

- For Risks of Localised calamities and Post-Harvest losses on account of defined peril, the Unit of Insurance for loss assessment shall be the affected insured field of the individual farmer.

Implementation

- Implemented on the basis of area approach.

- For defining a crop as a major crop for deciding the Insurance Unit level, the sown area of that crop should be

at least 25% of Gross cropped areain a District/Taluka or equivalent level. - Under the overall guidance & control of the Department Of Agriculture, Cooperation & Farmers Welfare.

- To be implemented by

Agricultural Insurance Companyand other empaneled private general insurance companies. (total 18 companies including 5 government)

- Selection of Implementing Agency (IA) is done by the concerned

state governmentthrough bidding. - The existing State Level Co-ordination Committee on Crop Insurance (SLCCCI), Sub-committee to SLCCCI, District Level Monitoring Committee (DLMC) shall be Responsible for proper management of the scheme.

Risks Covered

- Yield Losses (standing crops, on notified area basis). Comprehensive risk insurance is provided to cover yield losses due to non-preventable risks, such as Natural Fire and Lightning, Storm, Hailstorm, Cyclone, Typhoon, Tempest, Hurricane, Tornado. Risks due to Flood, Inundation and- Landslide, Drought, Dry spells, Pests/ Diseases also will be covered.

- On account payment up to 25% of likely claims will be provided, if the expected yield during the season is likely to be less than 50% of normal yield.

- In cases where majority of the insured farmers of a notified area, having intent to sow/plant and incurred expenditure for the purpose, are prevented from sowing/planting the insured crop due to adverse weather conditions, shall be eligible for indemnity claims upto a maximum of 25 % of the sum-insured.

- In post-harvest losses, coverage will be available up to a

maximum period of 14 daysfrom harvesting for those crops which are kept in “cut & spread” condition to dry in the field. - For certain localized problems, Loss / damage resulting from occurrence of identified localized risks like hailstorm, landslide, and Inundation affecting isolated farms in the notified area would also be covered.

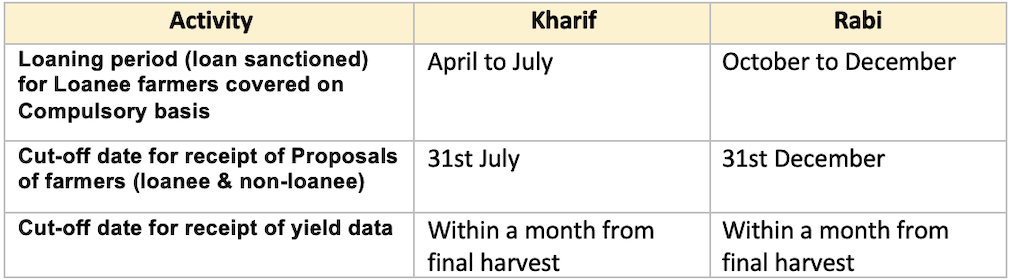

Calendar of activity

Comparison with previous schemes

Revised operational guidelines for Pradhan Mantri Fasal Bima Yojna (PMFBY)

- Government has modified operational guidelines for Pradhan Mantri Fasal Bima Yojna (PMFBY) which is being implemented from 1st of October, 2018.

- New provisions in the operational guidelines of PMFBY:

- Provision of Penalties/ Incentives for States, Insurance Companies (ICs) and Banks i.e. 12% interest rate to be paid by the Insurance Company to farmers for delay in settlement claims beyond two months of prescribed cutoff date. Similarly, State Govt. have to pay 12% interest rate for delay in release of State share of Subsidy beyond three months of prescribed cutoff date/submission of requisition by Insurance Companies.

- Detailed SOP for Performance evaluation of ICs and their de-empanelment.

- Inclusion of Perennial horticultural crops (on pilot basis) under the ambit of PMFBY. (Operational Guidlines of PMFBY envisages coverage of food and Oilseed crops and Annual Commercial & Horticultural crops).

- Inclusion of hailstorms in post-harvest losses, besides unseasonal and cyclonic rainfalls.

- Inclusion of cloud burst and natural fire in localized calamities in addition to hailstorm, landslide, and inundation.

- Add on coverage for crop loss due to attack of wild animals on pilot basis with the additional financial liabilities of this provision to be borne by concerned state Govt.

- Mandatory capturing of Adhaar number – This would help in de-duplication

- Target for Coverage to ICs especially of Non loanee farmers (10% incremental).

- Definition of Major Crops, Unseasonal rainfall and Inundation incorporated for clarity and proper coverage

- Rationalization of premium release process: Release of Upfront premium subsidy based on 50% of 80% of total share of subsidy of corresponding season of previous year as GOI/State subsidy at the beginning of the season- Companies need not provide any projections for the advance subsidy. Second Installment – balance premium based on approved business statistics on Portal for settlement of claims and final installment after reconciliation of entire coverage data on portal based on final business statistics on portal.

- States allowed to take decision for inclusion of crops having high premium for calculation of L1 calculation and for notification.

- Rationalization of methodology for calculation of TY

- Moving average of best

5 out of 7 yearsfor calculation of claim amount.Average yield of last 7 yearsminus two notified calamity years if any. NABARD 2020 Mains - Settlement of claims (Prevented sowing/ on account for Mid-season adversity / Localized Claims) without waiting for Second instalment of final subsidy.

- Yield based claims to be settled on the basis of subsidy provided on provisional business data.

- Separate Budget Allocation for Administrative expenses (at least 2% of budget of scheme).

- Broad Activity wise seasonality discipline containing defined timelines for all major activities to streamlines the process of coverage, submission of yield data and early settlement of claims.

- District wise crop wise crop calendar (for major crops) to decide cutoff date for enrolment.

- Increased time for change of crop name for insurance - upto 2 days prior to cutoff date for enrolment instead of earlier provision of 1 month before cutoff date.

- More time to insured farmer to intimate individual claims – 72 hours (instead of 48 hours) through any stakeholders and directly on portal.

- Timeline for declaration of prevented sowing.

- Detailed SOP for dispute redressal regarding yield data/crop loss.

- Detailed SOP for claims estimation w.r.t. Add on products i.e. Mid-season adversity, prevented/failed sowing, post-harvest loss and localized claims.

- Detailed SOP for Area Correction factor.

- Detailed SOP for Multi picking crops.

- Detailed plan for publicity and awareness- earmarked expenditure-0.5% of Gross premium per company per season.

- Use of RST in clustering/Risk classification.

- Penalties/ Incentives for States, ICs and Banks.

- Performance evaluation of ICs and their de-empanelment.

Weather based Crop Insurance Scheme (WBCIS)

- Started in

2007 - It is a unique Weather based Insurance Product designed to provide insurance protection against losses in crop yield resulting from adverse weather incidences. It provides payout against adverse rainfall incidence (both deficit & excess) during Kharif and adverse incidence in weather parameters like frost, heat, relative humidity, un-seasonal rainfall etc. during Rabi. It is not Yield guarantee insurance.

- This simply implies that if a farmer did not insure his crop under MNAIS but somehow his crops were damaged due to adverse weather conditions; he is still able to claim insurance if he goes with this component.

Crops covered

- Major Food crops (Cereals, Millets & Pulses) & Oilseeds

- Commercial / Horticultural crops

Perils covered

- Following major weather perils, which are deemed to cause “Adverse Weather Incidence”, leading to crop loss, shall be covered under the scheme.

- Rainfall – Deficit Rainfall, Excess rainfall, Unseasonal Rainfall, Rainy days, Dry-spell, Dry days

- Relative Humidity

- Temperature – High temperature (heat), Low temperature

- Wind Speed

- A combination of the above

- Hailstorms, cloud-burst may also be covered as Add-on/Index-Plus products for those farmers who have already taken normal coverage under WBCIS.

- The perils listed above are only indicative and not exhaustive, any addition deletion may be considered by insurance companies based on availability of relevant data.

Farmers covered

- All farmers including sharecroppers and tenant farmers growing the notified crops in the notified areas are eligible for coverage. However, farmers should have insurable interest on the insured crop. The non-loanee farmers are required to submit necessary documentary evidence of land records and / or applicable contract / agreements details (in case of sharecroppers / tenant farmers).

- All farmers availing Seasonal Agricultural Operations (SAO) loans from Financial Institutions (i.e. loanee farmers) for the crop(s) notified are covered on compulsory basis.

- The Scheme is optional for the non-loanee farmers. They can choose between WBCIS and PMFBY, and also the insurance company.

Risk period (i.e. Insurance Period)

- Risk period would ideally be from sowing period to maturity of the crop.

- Risk period depending on the duration of the crop and weather parameters chosen, could vary with individual crop and reference unit area and would be notified by SLCCCI before the commencement of risk period.

Restructured Weather Based Crop Insurance Scheme (RWBCIS)

- The RWBCIS was launched on 18th February 2016 by Hon’ble Prime Minister 12 states implemented the scheme in

Kharif 2016whereas 9 states have implemented the scheme in Rabi 2016-17.

Unified Package Insurance Scheme (UPIS)

- Unified package insurance scheme has also been approved for implementation in selected 45 districts on pilot basis from Kharif 2016.

- The Pilot includes seven sections viz., crop Insurance (PMFBY/ WBCIS), Loss of Life (PMJJBY), Accidental Death & Disability (PMSBY), Student-Safety, Household, Agriculture implements & Tractor. Crop insurance Section is compulsory.

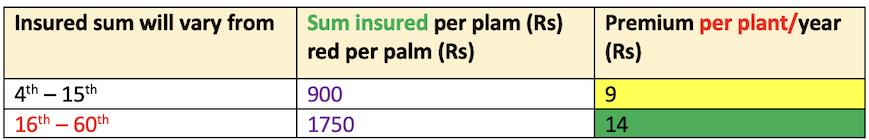

Coconut Palm Insurance Scheme (CPIS)

- The Coconut Palm Insurance Scheme (CPIS) is implemented since the year

2009-10. - Applicability: Since Dwarf and Hybrids begin to yield fruit from 4th year of planting, this variety of coconut palms in age range of

4-60 yearwill be covered under the scheme, but Tall variety coconut palms will be eligible for coverage for age range of7-60 year. Unhealthy and senile palms will be excluded from coverage. - Economic life of coconut palm is

60 yearAFO 2017 - Eligibility Criteria:

- As per the Scheme, individual farmer / grower offering at least 5 healthy nut bearing palms for insurance in specified age group, (4-60 years for dwarf, hybrid and 7-60 years for tall) contiguous area plot will be eligible for insurance.

Sum Insured & Premium

Premium Subsidy

- 50% will be paid by Coconut Development Board (CDB) and 25% by State Government concerned and balance

25% will be paid by farmer/ grower. - In case, the State government does not agrees to bear 25% share of premium, farmers / growers, will be required to pay 50% of premium, if interested in insurance scheme.

- In case some planters/growers’ association wishes to bear the premium on behalf of planters/growers, such associations may do so if they have, insurable interest’. In any case, the planters/growers shall bear a minimum of 10% premium.

Livestock Insurance Scheme

- The Livestock Insurance Scheme, a centrally sponsored scheme, which was implemented on a pilot basis during 2005-06 and 2006-07 of the 10th Five Year Plan and 2007-08 of the 11th Five Year Plan in 100 selected district the scheme is being implemented on a regular basis from

2008-09in 100 newly selected districts of the country. - The premium of the insurance is subsidized to the tune of 50%.

- The benefit of subsidy is being provided to a maximum of 2 animals per beneficiary for a policy of maximum of three years.

History

- In

1970, an Expert Committee on crop insurance under the Chairmanship of Dharamnarain was appointed by the Government of India to examine and analyses administrative and financial implications of the scheme with a view to introduce it. In his report he ruled out the possibility of implementing the scheme in India. - Prof Dhandekar strongly defended the implementation of the scheme.

- In 1973, the Government of India has set up General insurance Corpotation (GIC) to carry out all types of insurance business throughout the nation with four subsidiarity insurance companies.

- GIC first introduced the crop insurance scheme in 1973 on experimental basis on pilot scheme in selected centers of Gujarat. Only

H4 cottonwas considered for implementation of the scheme. Later the same was …

Become Successful With AgriDots

Learn the essential skills for getting a seat in the Exam with

🦄 You are a pro member!

Only use this page if purchasing a gift or enterprise account

Plan

Rs

- Unlimited access to PRO courses

- Quizzes with hand-picked meme prizes

- Invite to private Discord chat

- Free Sticker emailed

Lifetime

Rs

1,499

once

- All PRO-tier benefits

- Single payment, lifetime access

- 4,200 bonus xp points

- Next Level

T-shirt shipped worldwide

Yo! You just found a 20% discount using 👉 EASTEREGG

High-quality fitted cotton shirt produced by Next Level Apparel