🏊🏻♂️ Lead Bank Scheme

Learn about Lead Bank Scheme

Lead Bank Scheme

- The study group appointed by National Credit Council (NCC) in

1969under the chairmanship ofProf. D.R. Gadgilrecommended “Service Area Approach” for the development of financial structure. - In the same year i.e., 1969, RBI appointed Sri.

F.K.F. Nariman committeeto examine recommendations of Prof. Gadgil’s study group. The Nariman committee also endorsed the views of the Gadgil committee on “Service Area Approach” and recommended the formulation of “Lead Bank Scheme”. The RBI accepted the Nariman’s committee recommendations and lead bank scheme came into force from 1969. - Under the lead bank scheme, specific districts are allotted to each bank, which would take the lead role in identifying the potential areas for banking and expanding credit facilities.

- Lead bank is the leading bank among the commercial banks in a district i.e. having maximum number of bank branches in the district. Lead bank acts as a consortium leader for coordinating the efforts of all credit institutions in each allotted district for the development of banking and expansion of credit facilities.

Implementation of Lead Bank Scheme

A. Preparation of credit plans

Planning plays an important role in the implementation of the Lead Bank Scheme and a bottom-up approach is adopted to map the existing potential for development. Under LBS, planning starts with identifying block wise/activity wise potential estimated for various sectors.

B. Potential Linked Credit Plans (PLPs)

i) Potential Linked Credit Plans (PLPs) are a step towards decentralized credit planning with the basic objective of mapping the existing potential for development through bank credit. PLPs take into account the long term physical potential, availability of infrastructure support, marketing facilities, and policies/programmes of Government etc.

ii) A pre-PLP meeting is convened by LDM (Lead Development Manager) during June every year to be attended by the banks, Government agencies, etc., to reflect their views and concerns regarding credit potential (sector/activity-wise) and deliberate on major financial and socio-economic developments in the district in the last one year and priorities to be set out for inclusion in the PLP. DDM of NABARD will make a presentation in this meeting outlining the major requirements of information for preparing the PLP for the following year. The preparation of PLP for the next year is to be completed by August every year to enable the State Government to factor in the PLP projections.

iii) The procedure for preparing the District Credit Plan is as follows:

- a) Controlling Offices of commercial banks and Head Office of RRB and DCCB/LDB will circulate the accepted block-wise/activity-wise potential to all their branches for preparing the Branch Credit Plans (BCP) by their respective branch managers. Banks should ensure that the exercise of preparation of branch/block plans is completed in time by all branches so that the Credit Plans become operational on time.

- b) A special Block Level Bankers’ Committee (BLBC) meeting will be convened for each block where the Branch Credit Plans will be discussed and aggregated to form the Block Credit Plan. DDM and LDM will guide the BLBC in finalizing the plan ensuring that the Block Credit Plan is in tune with the potentials identified activity-wise including in respect of Government sponsored programmes.

- c) All the Block Credit Plans of the district will be aggregated by LDM to form the District Credit Plan. This plan indicates an analytical assessment of the credit need of the district to be deployed by all the financial institutions operating in the district and total quantum of funds to be earmarked as credit by all the financial institutions for a new financial year. The Zonal/Controlling Offices of banks, while finalizing their business plans for the year, should take into account the commitments made in the DCP which should be ready well in time before the performance budgets are finalized.

d) The District Credit Plan will be placed before the DCC by the Lead District Manager for final acceptance/approval. All the District Credit Plans would eventually be aggregated into State Level Credit Plan to be prepared by SLBC convenor bank and launched by 1st of April every year.

C. Monitoring the performance of credit plans

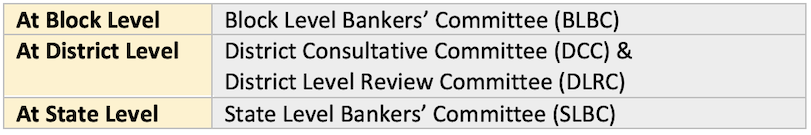

Fora under Lead Bank Scheme

Block Level Bankers Committee (BLBC)

- BLBC is a forum for achieving coordination between credit institutions on one hand and field level development agencies on the other.

- The forum prepares and reviews implementation of Block Credit Plan and also resolves operational problems in implementation of the credit programmes of banks.

- Lead District Manager of the district is the Chairman of the Block Level Bankers’ Committee.

- All the banks operating in the block including the District Central Co-operative Banks and RRB, Block Development Officer, technical officers in the block, such as extension officers for agriculture, industries and co-operatives are members of the Committee.

- BLBC meetings are held at

quarterlyintervals. NABARD 2020 - The LDO of RBI and the DDM of NABARD selectively attend the meetings of the BLBCs. The representatives of Panchayat Samitis are also invited to attend the meetings at half yearly intervals so as to share their knowledge and experience on rural development in the credit planning exercise.

District Consultative Committee (DCC)

Constitution of DCC

- The District Consultative Committees were constituted in the early seventies as a common forum at the district level for bankers as well as Government agencies/ departments to facilitate coordination in implementing various developmental activities under the Lead Bank Scheme.

- Reserve Bank of India, NABARD, all the commercial banks in the district, co-operative banks including District Central Cooperative Bank (DCCB), RRBs, various State Government departments and allied agencies are the members of the DCC. Conduct of DCC Meetings

- DCC meetings should be convened by the Lead Banks at

quarterlyintervals. - DCC meetings are chaired by District Collector (DC). Agenda for DCC Meetings

- Review of progress under financial inclusion plan (FIP).

- Doubling of Farmers’ Income by 2022

- Review of performance of banks under District Credit Plan (DCP)

- Progress under SHG - bank linkage

State Level Bankers’ Committee (SLBC)

- The State Level Bankers’ Committee (SLBC) was constituted in April 1977, as an apex inter-institutional forum to create adequate coordination machinery in all States, on a uniform basis for development of the State SLBC is chaired by the Chairman & Managing Director (CMD) /Executive Director of the Convener Bank.

- Discussion on implementation of Model Land Leasing Act 2016 (exploring possibility).

- Lead Bank Scheme is administered by the Reserve Bank of India since 1969. The assignment of Lead Bank responsibility to designated banks in every district is done by the Reserve Bank of India following a detailed procedure formulated for this purpose. As on June 30, 2019, 18 public sector banks and one private sector bank have been assigned Lead Bank responsibility in 717 districts of the country.

- State Bank of India has highest number of lead bank in the country.

- Uttar Pradesh has highest number of lead bank districts in the country.

Lead Bank Scheme

- The study group appointed by National Credit Council (NCC) in

1969under the chairmanship ofProf. D.R. Gadgilrecommended “Service Area Approach” for the development of financial structure. - In the same year i.e., 1969, RBI appointed Sri.

F.K.F. Nariman committeeto examine recommendations of Prof. Gadgil’s study group. The Nariman committee also endorsed the views of the Gadgil committee on “Service Area Approach” and recommended the formulation of “Lead Bank Scheme”. The RBI accepted the Nariman’s committee recommendations and lead bank scheme came into force from 1969. - Under the lead bank scheme, specific districts are allotted to each bank, which would take the lead role in identifying the potential areas for banking and expanding credit facilities.

- Lead bank is the …

Become Successful With AgriDots

Learn the essential skills for getting a seat in the Exam with

🦄 You are a pro member!

Only use this page if purchasing a gift or enterprise account

Plan

- Unlimited access to PRO courses

- Quizzes with hand-picked meme prizes

- Invite to private Discord chat

- Free Sticker emailed

Lifetime

- All PRO-tier benefits

- Single payment, lifetime access

- 4,200 bonus xp points

- Next Level

T-shirt shipped worldwide

Yo! You just found a 20% discount using 👉 EASTEREGG

High-quality fitted cotton shirt produced by Next Level Apparel