🧚 Priority Sector Lending

Learn basics of Priority Sector Lending

The Priority Sector Lending (PSL) guidelines issued by Reserve Bank of India were last reviewed for Commercial Banks in April 2015 and for UCBs in May 2018 respectively. With an objective to harmonise various instructions issued to Commercial Banks, SFBs, RRBs, UCBs and LABs; align these guidelines with emerging national priorities and bring sharper focus on inclusive development, it was decided to comprehensively review the PSL guidelines. The revised guidelines also aim to encourage and support environment friendly lending policies to help achieve Sustainable Development Goals (SDGs). This review also took into account the recommendations made by the ‘Expert Committee on Micro, Small and Medium Enterprises (Chairman: Shri U.K. Sinha) and the ‘Internal Working Group to Review Agriculture Credit’ (Chairman: Shri M. K. Jain) apart from discussions with all stakeholders.

Applicability

The provisions of these Directions shall apply to every Commercial Bank [including Private banks, Regional Rural Bank (RRB), Small Finance Bank (SFB), Local Area Bank(LAB) and Primary (Urban) Co-operative Bank (UCB) other than Salary Earners’ Bank licensed to operate in India by the Reserve Bank of India.

👉🏻 Categories under priority sector:

- Agriculture

- Education

- Micro, Small and Medium Enterprises

- Export Credit

- Housing

- Social Infrastructure

- Renewable Energy

- Others

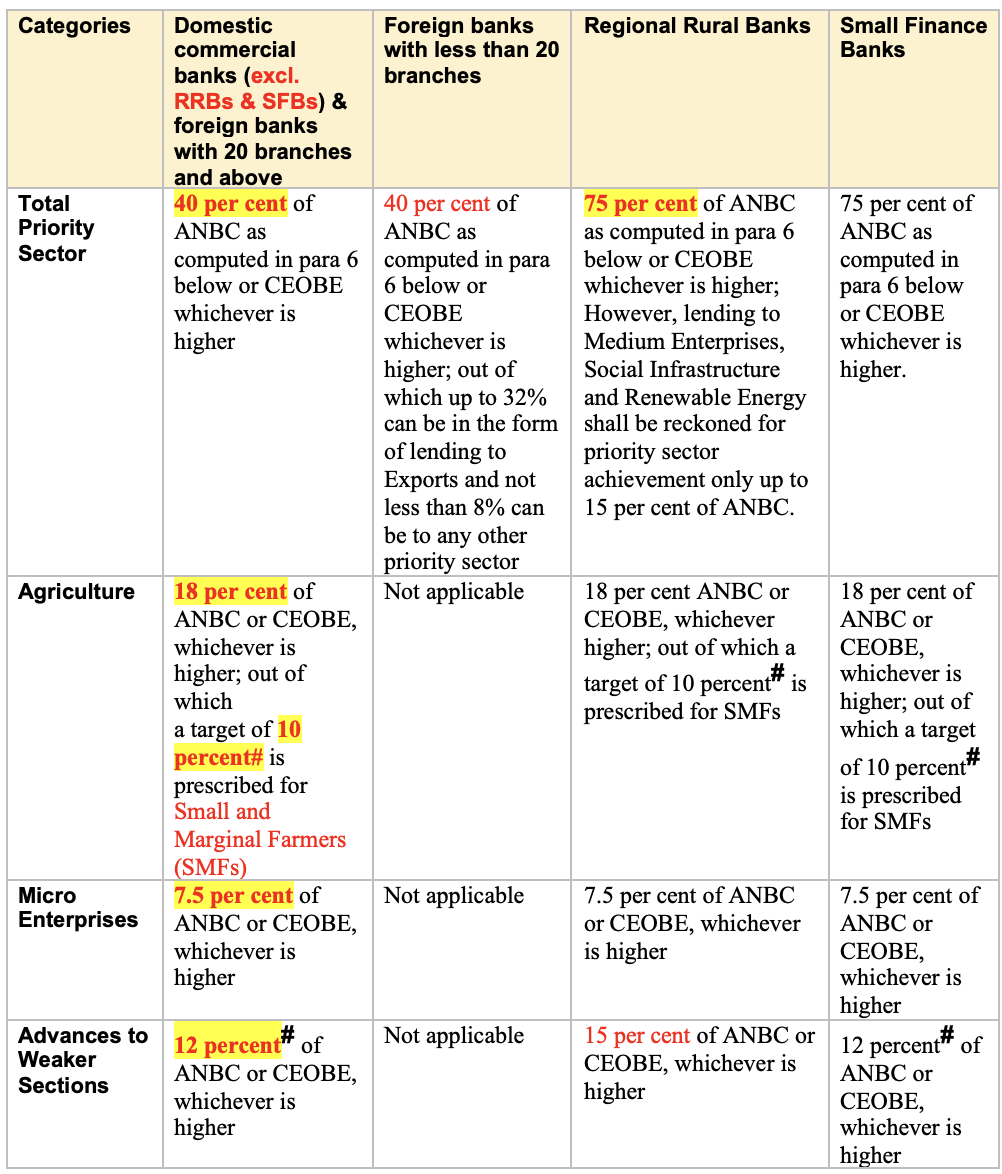

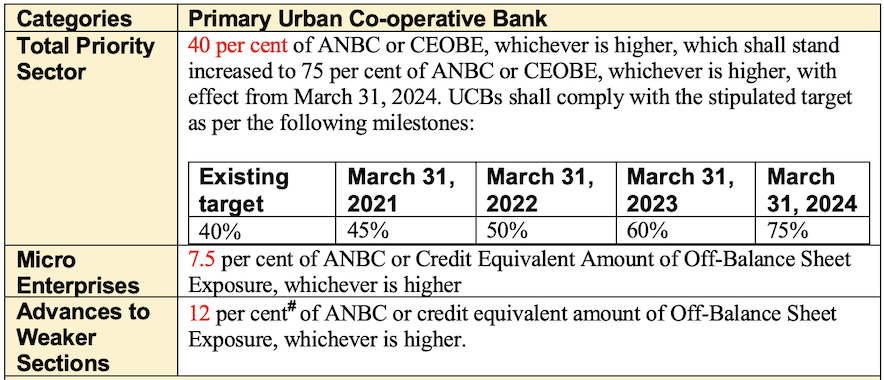

- The targets and sub-targets set under priority sector lending, to be computed on the basis of the Adjusted Net Bank Credit (ANBC)/ Credit Equivalent of Off-Balance Sheet Exposures (CEOBE) as applicable as on the corresponding date of the preceding year, are as under:

The targets and sub-targets for banks under priority sector are as follows:

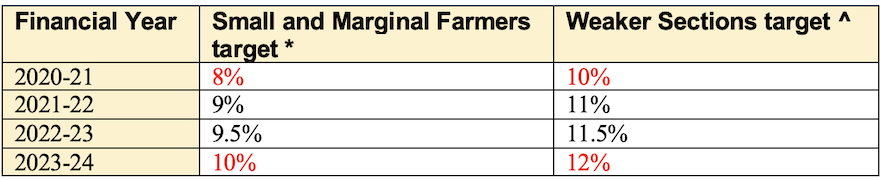

The targets for lending to SMFs and for Weaker Sections shall be revised upwards from FY 2021-22 onwards as follows:

- 🙋🏼 * Not applicable to UCBs

- ^ Weaker Sections target for RRBs will continue to be 15% of ANBC or CEOBE, whichever is higher.

👉🏻 All domestic banks (other than UCBs) and foreign banks with more than 20 branches are directed to ensure that the overall lending to Non-Corporate Farmers (NCFs) does not fall below the system-wide average of the last three years’ achievement which will be separately notified every year. The applicable target for lending to the non-corporate farmers for FY 2021-22 will be 12.73% of ANBC or CEOBE whichever is higher. All efforts should be made by banks to reach the level of 13.5 percent NABARD of ANBC (erstwhile target for direct lending to agriculture sector).

Description of Eligible categories under Priority Sector

Agriculture

- The lending to agriculture sector will include

Farm Credit(Agriculture and Allied Activities), lending for Agriculture Infrastructure and Ancillary Activities.

Farm Credit - Individual farmers

Loans to individual farmers [including Self Help Groups (SHGs) or Joint Liability Groups (JLGs) i.e. groups of individual farmers, provided banks maintain disaggregated data of such loans] and Proprietorship firms of farmers, directly engaged in Agriculture and Allied Activities, viz. dairy, fishery, animal husbandry, poultry, bee-keeping and sericulture. This will include:

- Crop loans including loans for traditional/non-traditional plantations, horticulture and allied activities.

- Medium and long-term loans for agriculture and allied activities (e.g. purchase of agricultural implements and machinery and developmental loans for allied activities).

- Loans for pre and post-harvest activities viz. spraying, harvesting, grading and transporting of their own farm produce.

- Loans to distressed farmers indebted to non-institutional lenders.

- Loans under the Kisan Credit Card Scheme.

- Loans to small and marginal farmers for purchase of land for agricultural purposes.

- Loans against pledge/hypothecation of agricultural produce (including warehouse receipts) for a period not exceeding 12 months subject to a limit up to

₹75 lakhRRB SO 2021 against NWRs/eNWRs and up to₹50 lakhagainst warehouse receipts other than NWRs/eNWRs. - Loans to farmers for installation of stand-alone Solar Agriculture Pumps and for solarisation of grid connected Agriculture Pumps.

- Loans to farmers for installation of solar power plants on barren/fallow land or in stilt fashion on agriculture land owned by farmer.

- Farm Credit - Corporate farmers, Farmer Producer Organisations (FPOs)/(FPC) Companies of Individual Farmers, Partnership firms and Co-operatives of farmers engaged in Agriculture and Allied Activities.

- (a) Loans for the following activities will be subject to an aggregate limit of

₹2 croreper borrowing entity:- i. Crop loans to farmers which will include traditional/non-traditional plantations and horticulture and loans for allied activities.

- ii. Medium and long-term loans for agriculture and allied activities (e.g. purchase of agricultural implements and machinery and developmental loans for allied activities).

- iii. Loans for pre and post-harvest activities viz. spraying, harvesting, grading and transporting of their own farm produce.

- (b) Loans up to

₹75 lakhagainst pledge/hypothecation of agricultural produce (including warehouse receipts) for a period not exceeding 12 months against NWRs/eNWRs and up to₹50 lakhagainst warehouse receipts other than NWRs/eNWRs. - (c) Loans up to

₹5 croreper borrowing entity to FPOs/FPCs undertaking farming with assured marketing of their produce at a pre-determined price. - (d) UCBs are not permitted to lend to co-operatives of farmers.

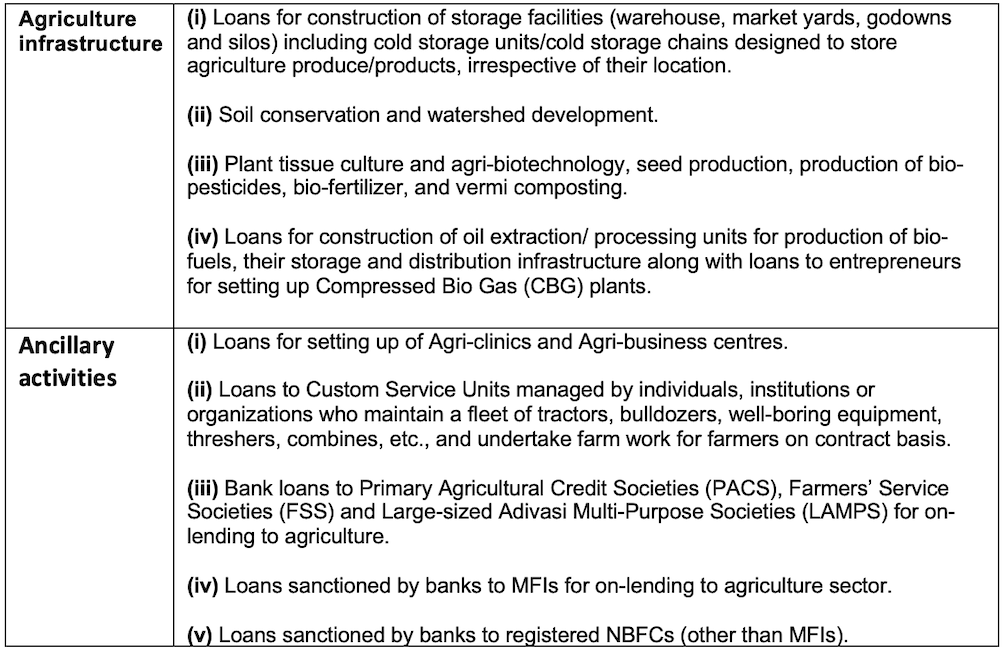

Agriculture Infrastructure

Loans for agriculture infrastructure will be subject to an aggregate sanctioned limit of ₹100 crore per borrower from the banking system. List of activities included are as follows:

Ancillary Services

- Following loans under ancillary services will be subject to limits prescribed as under:

- (a) Loans up to

₹5 croreto co-operative societies of farmers for purchase of the produce of members (Not applicable to UCBs) - (b) Loans up to

₹50 croreto Start-ups, as per definition of Ministry of Commerce and Industry, Govt. of India that are engaged in agriculture and allied services. - (c) Loans for Food and Agro-processing up to an aggregate sanctioned limit of

₹100 croreper borrower from the banking system.

- (a) Loans up to

- Outstanding deposits under RIDF and other eligible funds with NABARD on account of priority sector shortfall.

- There are some eligible activities under ancillary services and food processing. (list on RBI Website)

Small and Marginal Farmers (SMFs)

- For the purpose of computation of achievement of the sub-target, Small and Marginal Farmers will include the following:

- (a) Farmers with landholding of up to 1 hectare (Marginal Farmers).

- (b) Farmers with a landholding of more than 1 hectare and up to 2 hectares (Small Farmers).

- (c) Landless agricultural labourers, tenant farmers, oral lessees and share - croppers whose share of landholding is within the limits prescribed for SMFs.

- (d) Loans to Self Help Groups (SHGs) or Joint Liability Groups (JLGs), i.e. groups of individual SMFs directly engaged in Agriculture and Allied Activities, provided banks maintain disaggregated data of such loans.

- (e) Loans up to ₹2 lakh to individuals solely engaged in Allied activities without any accompanying land holding criteria.

- (f) Loans to FPOs/FPC of individual farmers and co-operatives of farmers directly engaged in Agriculture and Allied Activities where the land-holding share of SMFs is not less than 75 per cent. UCBs are not permitted to lend to co-operatives of farmers.

Lending by banks to NBFCs and MFIs for on-lending in agriculture

- (i) Bank credit extended to registered NBFC-MFIs and other MFIs (Societies, Trusts etc.) which are members of RBI recognised SRO for the sector, for on-lending to individuals and also to members of SHGs / JLGs will be eligible for categorisation as priority sector advance under respective categories of agriculture (not applicable to RRBs, UCBs, SFBs and LABs).

- (ii) Bank credit to registered NBFCs (other than MFIs) towards on-lending for ‘Term lending’ component under agriculture will be allowed up to ₹ 10 lakh per borrower (not applicable to RRBs, UCBs, SFBs and LABs).

Micro, Small and Medium Enterprises (MSMEs)

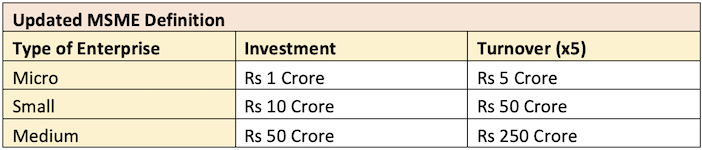

The definition of MSMEs

Revised Guideline under AtmaNirbhar Abhiyan

Further, such MSMEs should be engaged in the manufacture or production of goods, in any manner, pertaining to any industry specified in the First Schedule to the Industries (Development and Regulation) Act, 1951 or engaged in providing or rendering of any service or services. All bank loans to MSMEs conforming to the above guidelines qualify for classification under priority sector lending.

Khadi and Village Industries Sector (KVI)

- All loans to units in the KVI sector will be eligible for classification under the sub-target of 7.5 percent prescribed for Micro Enterprises under priority sector.

Other Finance to MSMEs

- Loans up to

₹50 crore to Start-ups, as per definition of Ministry of Commerce and Industry, Govt. of India that confirm to the definition of MSME. - Loans to entities involved in assisting the decentralized sector in the supply of inputs and marketing of output of artisans, village and cottage industries.

- In respect of UCBs, the term “entities” shall not include institutions to which UCBs are not permitted to lend under the RBI guidelines / the legal framework governing their functioning.

- Loans to co-operatives of producers in the decentralized sector viz. artisans, village and cottage industries (Not applicable for UCBs).

- Loans sanctioned by banks to NBFC-MFIs and other MFIs (Societies, Trusts etc.) which are members of RBI recognised SRO for the sector for on-lending to MSME sector (not applicable to RRBs, SFBs and UCBs)

- Loans to registered NBFCs (other than MFIs) for on-lending to Micro & Small Enterprises (not applicable to RRBs, SFBs and UCBs)

- Credit outstanding under General Credit Cards (including Artisan Credit Card, Laghu Udyami Card, Swarojgar Credit Card and Weaver’s Card etc. in existence and catering to the non-farm entrepreneurial credit needs of individuals).

- Overdraft to Pradhan Mantri Jan-Dhan Yojana (PMJDY) account holders as per limits and conditions prescribed by Department of Financial Services, Ministry of Finance from time to time, will qualify as achievement of the target for lending to Micro Enterprises.

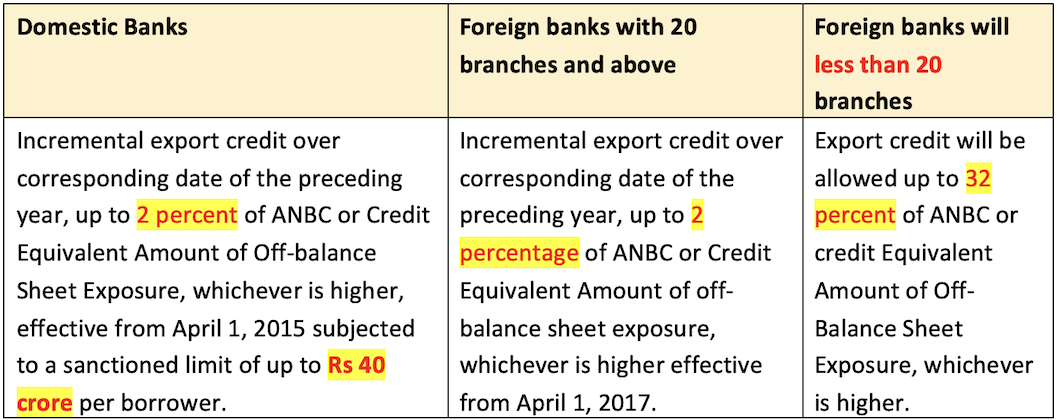

Export Credit

The Export credit extended as per the details below will be classified as priority sector.

Education

- Loans to individuals for educational purposes, including vocational courses,

not exceeding ₹ 20 lakhwill be considered as eligible for priority sector classification. Loans currently classified as priority sector will continue till maturity.

Housing

Bank loans to Housing sector as per limits prescribed below are eligible for priority sector classification:

- Loans to individuals up to

₹35 lakhin metropolitan centres (with population of ten lakh and above) and up to₹25 lakhin other centres for purchase/construction of a dwelling unit per family provided the overall cost of the dwelling unit in the metropolitan centre and at other centres does not exceed ₹45 lakh and ₹30 lakh respectively. Existing individual housing loans of UCBs presently classified under PSL will continue as PSL till maturity or repayment. - Loans up to

₹10 lakhin metropolitan centres and up to₹6 lakhin other centres for repairs to damaged dwelling units conforming to the overall cost of the dwelling unit. - Bank loans to any governmental agency for construction of dwelling units or for slum clearance and rehabilitation of slum dwellers subject to dwelling units with carpet area of not more than

60 sq.m. - Housing loans to banks’ own employees will

notbe eligible for classification under the priority sector. - Since Housing loans which are backed by long term bonds are exempted from ANBC, banks should not classify such loans under priority sector.

- Investments made by UCBs in bonds issued by NHB / HUDCO on or after April 1, 2007 shall

notbe eligible for classification under priority sector.

Social infrastructure

- Bank loans up to a limit of

₹5 croreper borrower for setting up schools, drinking water facilities and sanitation facilities including construction/ refurbishment of household toilets and water improvements at household level, etc. and loans up to a limit of₹10 croreper borrower for building health care facilities including under ‘Ayushman Bharat’ in Tier II to Tier VI centres. In case of UCBs, the above limits are applicable only in centres having a population of less than one lakh.

Renewable Energy

- Bank loans up to a limit of

₹30 croreto borrowers for purposes like solar based power generators, biomass-based power generators, wind mills, micro-hydel plants and for non-conventional energy based public utilities, viz., street lighting systems and remote village electrification etc., will be eligible for Priority Sector classification. - For individual households, the loan limit will be

₹10 lakhper borrower.

Other

- Loans not exceeding

₹1.00 lakhper borrower provided directly by banks to individuals and individual members of SHG/JLG, provided the individual borrower’s household annual income in rural areas does not exceed ₹1.00 lakh and for non-rural areas it does not exceed ₹1.60 lakh, and loans not exceeding₹2.00 lakhprovided directly by banks to SHG/JLG for activities other than agriculture or MSME, viz., loans for meeting social needs, construction or repair of house, construction of toilets or any viable common activity started by the SHGs. - Loans to distressed persons [other than distressed farmers indebted to non-institutional lenders] not exceeding

₹1.00 lakhper borrower to prepay their debt to non-institutional lenders. - Loans sanctioned to State Sponsored Organisations for Scheduled Castes/ Scheduled Tribes for the specific purpose of purchase and supply of inputs and/or the marketing of the outputs of the beneficiaries of these organisations.

- Loans up to

₹50 croreto Start-ups, as per definition of Ministry of Commerce and Industry, Govt. of India that are engaged in activities other than Agriculture or MSME.

Weaker Sections

- Small and Marginal Farmers

- Artisans, village and cottage industries where individual credit limits do not exceed ₹ 1 lakh

- Beneficiaries under Government Sponsored Schemes such as National Rural Livelihoods Mission (NRLM), National Urban Livelihood Mission (NULM) and Self Employment Scheme for Rehabilitation of Manual Scavengers (SRMS)

- Scheduled Castes and Scheduled Tribes

- Beneficiaries of Differential Rate of Interest (DRI) scheme.

- Self Help Groups (SHGs)

- Distressed farmers indebted to non-institutional lenders.

- Distressed persons other than farmers, with loan amount not exceeding ₹ 1 lakh per borrower to prepay their debt to non-institutional lenders

- Individual women beneficiaries up to ₹ 1 lakh per borrower.

- Persons with disabilities.

- Overdraft limit to PMJDY account holder upto ₹ 10,000/- with age limit of 18-65 years.

- Minority communities as may be notified by Government of India from time to time.

- Overdraft availed by PMJDY account holders as per limits and conditions prescribed by Department of Financial Services, Ministry of Finance from time to time may be classified under Weaker Sections.

- In States, where one of the minority communities notified is, in fact, in majority, item (xi) will cover only the other notified minorities. These States/ Union Territories are Punjab, Meghalaya, Mizoram, Nagaland, Lakshadweep and Jammu & Kashmir.

Priority Sector Lending Certificates (PSLCs)

- PSLCs are a mechanism to enable banks to achive the priority sector lending target and sub-targets by purchase of these instruments in the event of shortfall.

- This also incentivizes surplus banks as it allows them to sell their excess achievement over targets thereby enhancing lending to the categories under priority sector.

Penalty

- Whenever there is shortfall from the target of priority sector, bank has to deposit the short amount to the

Rural Infrastructure Development FundNABARD 2020 established with NABARD and other funds with NABARD/NHB/SIDBI/MUDRA Ltd. As decided by the Reserve Bank from time to time.

The Priority Sector Lending (PSL) guidelines issued by Reserve Bank of India were last reviewed for Commercial Banks in April 2015 and for UCBs in May 2018 respectively. With an objective to harmonise various instructions issued to Commercial Banks, SFBs, RRBs, UCBs and LABs; align these guidelines with emerging national priorities and bring sharper focus on inclusive development, it was decided to comprehensively review the PSL guidelines. The revised guidelines also aim to encourage and support environment friendly lending policies to help achieve Sustainable Development Goals (SDGs). This review also took into account the recommendations made by the ‘Expert Committee on Micro, Small and Medium Enterprises (Chairman: Shri U.K. Sinha) and the ‘Internal Working Group to Review Agriculture …

Become Successful With AgriDots

Learn the essential skills for getting a seat in the Exam with

🦄 You are a pro member!

Only use this page if purchasing a gift or enterprise account

Plan

- Unlimited access to PRO courses

- Quizzes with hand-picked meme prizes

- Invite to private Discord chat

- Free Sticker emailed

Lifetime

- All PRO-tier benefits

- Single payment, lifetime access

- 4,200 bonus xp points

- Next Level

T-shirt shipped worldwide

Yo! You just found a 20% discount using 👉 EASTEREGG

High-quality fitted cotton shirt produced by Next Level Apparel