🏛 Sources

Learn basics of Sources Agriculture Finance

Co-operative in India

- Cooperative society is a basic institution for socio-economic growth of the villagers.

- Basic principle: “Each for all and all for each”.

- Minimum 10 members are required to register a co-operative society.

Principles of Cooperative Society UPPSC 2021

- Principle of Open and Voluntary association

- Principle of democratic organisation

- Principle of service

- Principle of self-help and mutual help

- Principle of distribution of profits and surpluses

- Principle of political and religious neutrality

- Principle of education

- Principle of thrift

- Principle of publicity

- Principle of honorary service

👉🏻 Co-operative movement in the Indian context in the pre-independence era can be classified into four phases:

- Initiation stage (1904-1911)

- Modification stage (1912-1918)

- Expansion stage (1919-1929)

- Restructuring stage (1930-1946)

History

1904 Act

- Cooperative movement in India started in 1904 when Cooperative Credit Societies act was passed. Father of cooperative movement in India was

F. Nicholson. - Limitations of 1904 Act: No any provision for the formation of non-credit societies.

1912 Act

- Provision for the formation of non-credit societies with the aim to improve the economic status of its members as well as to meet the daily requirement. There was Provision for the formation of central cooperative society also (no provision in 1904 act).

- The Govt. appointed a committee under Sir Macglan in 1914 and it observed that people were had the impression that cooperatives were mainly the govt. agencies. Therefore he recommended:

- For the proper education of the cooperative principles so as that members may participate efficiently.

- The formation of cooperative banks to help the primary cooperative societies.

- To form the provincial cooperative society in each state.

- For careful scrutiny of members before granting loans.

- In 1944, Govt. appointed an agricultural finance sub-committee under Prof. D.R. Gadgil to study the cooperative movement and to give suggestion for their improvement.

- In 1945, Govt. appointed a Cooperative Planning Committee which submitted its report in 1946.

- In 1951, All India Rural Survey Committee Report was published. The chairman of the committee was A.D. Gorwala. Its recommendations were:-

- Organization of large size cooperative society

- Organization of Marketing Cooperatives

- Assistance from govt. in the form of loans and subsidies to the society.

- Adoption of system of controlled credit.

- Establishment of SBI as institution which may assist the Cooperative Society through its rural branches.

- In 1954, the All India Rural Cooperative Society recommended for the formation of large size society.

- Indian National Congress in 1959 at Nagpur session accepted the resolution of Agrarian Economy and this resolution brought a radical change in the policy and programme of cooperative movement.

- Multipurpose Cooperative societies were first established in 1939 in Orissa.

- The year 1954 is a landmark in the history of rural credit and Rural Credit policy in India.

- ‘Co-Operation’ is originated in Europe. Britain is the homeland of cooperative store movement.

- Primary objective of cooperative marketing is to reduce marketing margin and to assure the farmer a better price.

- Multi-unit Co-operative Societies Act, (1942) governs the working of Co-operative societies whose objects and area of operation extend to more than one state.

- National Co-operative Development Corporation (NCDC) Act

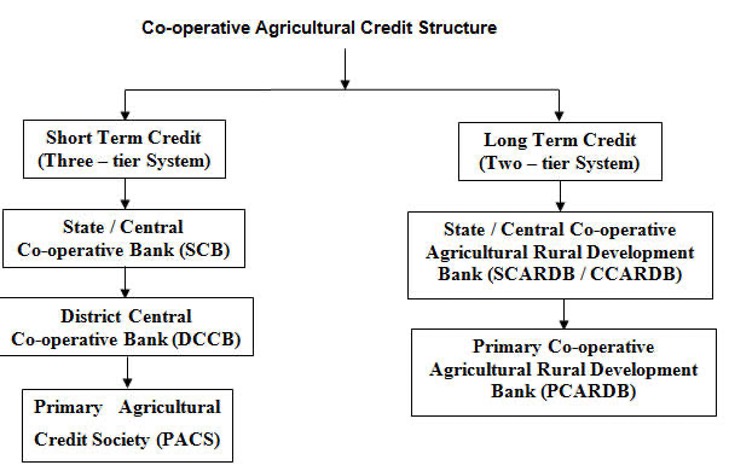

1962by repealing earlier Act. NCDC Act was enacted which replaced the earlier NCDC Board. - The co-operative credit structure in India is characterized by two types of institutions: one, involved in the dispensation of short and medium-term credit and the other in the provision of long term credit.

- The Primary Agricultural Credit Society (PACS) / Primary Agricultural Co-operative Bank (PACB) is the foundation stone on which the whole co-operative credit structure is built up.

- These societies are federated to District Central Co-operative Bank (DCCB), generally at the district level. The DCCBs are federated to State Co-operative Bank (SCB) which is an apex institution at the state level having close link with the RBI and NABARD.

- Long term credit is provided by Land Development Banks (LDBs).

- The State / Central Land Development Bank (now renamed as State Co-operative Agricultural Rural Development Banks (SCARDBs) is the apex institution which operates through Primary Land Development Banks (PLDBs) (now renamed as Primary Co-operative Agricultural Rural Development Banks (PCARDBs) at district / taluk / block level in some states or through its own branches where PCARDBs do not exist.

a) Primary Agricultural Credit Society (PACS)

- The formation of these societies dates back to 1904 when the first Co-operative Credit Societies Act was passed.

- The objective was to provide cheap credit to the farmers in order to relieve them from the clutches of money lenders.

- Many PACS also undertake multiple activities like sale of fertilizers and other agricultural inputs and several act as distributors of ration items under the Public Distribution System (PDS).

- The main functions of the PACS are:

- to promote economic interests of the members in accordance with the co-operative principles;

- to provide short and medium-term loans;

- to promote savings habit among members;

- to supply agricultural inputs like fertilizers, seeds, insecticides and implements;

- to provide marketing facilities for the sale of agricultural produces; and

- to supply domestic products requirements such as sugar, kerosene, etc.

b) District Central Co-operative Banks (DCCBs)

- CCB / DCCBs form an important link between PACS and SCBs.

Functions

- to meet the credit requirements of member societies;

- to perform banking business; to act as balancing centres for the PACS by diverting the surplus funds of some societies to those which face shortage of funds;

- to guide and supervise the PACS; and

- to undertake non-credit activities.

c) State Co-operative Bank (SCB)

- It is the apex institution at the state level which links widely scattered PACS with the money market, Reserve Bank of India and the Cooperative movement.

- The main objective of the bank is to link the widely scattered PACS with the money market and the RBI and to co-ordinate the work of CCB / DCCBs.

- The Functions of SCBs are:

- to act as bankers’ bank to DCCBs and to supervise, control and guide them;

- to mobilize financial resources needed by the PACS and deploy them properly among the various sectors of the movement;

- to co-ordinate the various development agencies and help the government in drawing plans for co-operative development and their implementation;

- to formulate and execute uniform credit policies for co-operative movement;

d) Land Development Banks

- First mortgage bank was established in 1920 in Punjab. But real beginning started by the establishment of central land mortgage bank in 1929 at Madras - for centralizing the issue of debentures and for coordinating the working of primary land development banks in the state.

- In the beginning of 3rd five year plan, the name of this bank was changed into Land Development Bank (LDB) in order to give credit facilities to the farmers for development of Agriculture.

- The advent of new innovations in agricultural technology, increasing demand for food with population explosion, profitability in commercial agriculture, attractive price for exportable agricultural commodities, etc. made the farmers to realize that agriculture could also be taken up as an industry by effecting improvement on land for increasing its production potential through more capital investment, which led to the raising demand for long term credit.

- Farmers required larger amount to acquire durable farm assets such as machineries and livestock and undertake permanent land improvements, construction of wells, buildings, erection of pump — sets, redemption of old debts, etc.

- Since the amount is large, it is difficult for them to repay the loan amount in lump sum. The amount has to be repaid in installments and distributed to a longer period of even 20 years.

Sahakar-Se-Samriddhi: From Cooperation to Prosperity

- The cooperative societies, especially in the agriculture, dairy and fisheries sectors, provide the rural population with livelihood opportunities and a financial safety net with a community-based approach.

- Cooperatives hold the key to rural economic transformation.

- There are 8.5 lakh registered cooperatives in the country, having more than 29 crore members mainly from the marginalised and lower-income groups in the rural areas, and 98 per cent of villages are covered by Primary Agriculture Credit Societies (PACS).

- To realise the vision of “Sahakar-see-Samriddhi”, a renewed impetus was given to the growth of the cooperative sector.

- Currently, around 19 per cent of agriculture finance is through cooperative societies.

- A full-fledged Ministry of Cooperation was established in July 2021 to provide greater focus to the cooperative sector.

- In addition, the Government has taken various initiatives to promote and strengthen PACS, like the computerisation of 63,000 functional PACS and the preparation of by-laws for enabling PACS to expand their activities.

- The Multi-State Cooperative Societies Act, 2002 (MSCS) was enacted after repealing the Multi-State Cooperative Act 1984, to facilitate the democratic functioning and autonomous working of Multi-State Cooperative Societies in line with the established Cooperative Principles.

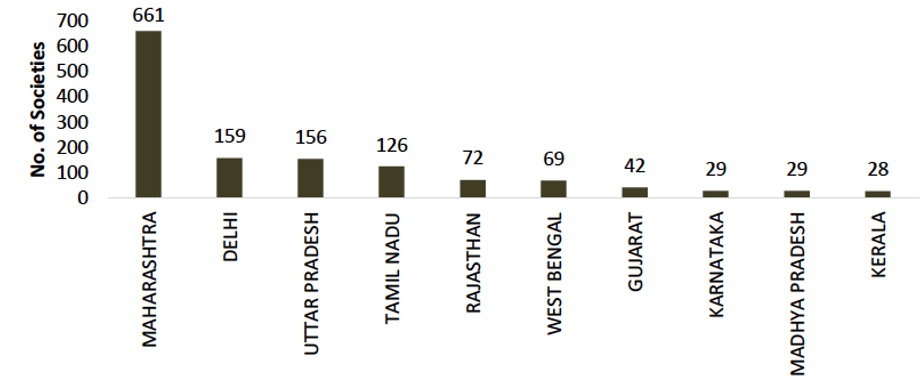

- As of date, there are 1528 registered societies under the Multi-State Cooperative Societies Act 2002. The MSCSs include 66 Multi-State Cooperative Banks with deposits of approx. Rs 2.6 lakh crore. Maharashtra leads 661 cooperatives, followed by Delhi and Uttar Pradesh.

Top ten states with Multi-State Cooperative Societies as on 20 October 2022

Some other cooperative finance institutions

Large-Sized Adivasi Multi-Purpose Co-operative Societies (LAMPS)

- LAMPS have been set up on the recommendations of the study team (Committee on Cooperative Structure in Tribal Areas) under the Chairmanship of Shri.

Bawaappointed by the government of India in1971. - These societies operate mainly in hill and tribal areas.

- The objectives of LAMPS are:

- to provide all types of credit, including those for meeting social obligations and consumer requisites under single roof;

- to provide technical guidance in the intensification and modernization of agriculture;

- to supply of inputs and essential commodities; and

- to arrange for the marketing of agricultural and minor forest products besides the products of the subsidiary occupations of the tribals.

Farmers’ Service Society (FSS)

- By early 1970s, it was found that the multi-purpose PACS had not succeeded much in diversifying their operations, especially commodity marketing and processing, in reaching the weaker sections and in becoming viable.

- They mostly under the control of the better-off sections of the society and the small and marginal farmers were not able to get access to the society or its services.

- The societies were not able to provide a variety of services like funding infrastructural development such as godowns and agro-service centre as well as providing finances for processing industries in their localities other than credit, and supply of inputs.

- Hence, based on the recommendation of National Commission on Agriculture, the scheme of setting up FSS to cater to the credit and non-credit needs of farmers at a single point was launched in

1973. - A Group constituted by the Union Cabinet in July 1974 under the leadership of

T.A. Pairecommended the organization of FSS to meet the credit needs of rural area. - The study Team head by T.A. Pai recommended the setting up of ‘Farmers Service Co-operatives’. FSS has been evolved to change the power structure in favour of weaker sections in rural areas and at the same time it will strengthen the co-operative movement through adoption of commercial banking principles in the management of its finances.

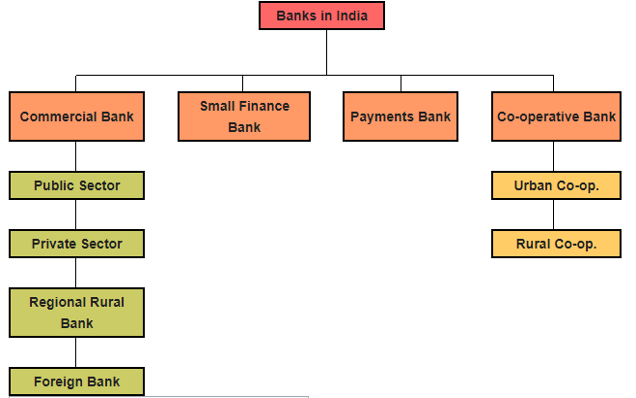

Commercial Banks

Nationalization of Banks

First

👉🏻 14 banks in 1969 (> 50 Crore)

Second

👉🏻 6 banks in 1980 (> 200 Crore)

👉🏻 Currently there are 12 Nationalized Public Sector Banks in India after mergers.

Regional Rural Banks (RRBs)

- Committee on Rural Banks headed by M. Narasimhan (1975).

- RRB came into existence as a result of measures taken under 20 point economic programme in 1975 by Indira Gandhi.

- Regional Rural Banks (RRBs) were set up under the provisions of

26 September 1975ordinance and theRRB Act of 1976to allocate banking and credit services for agriculture and other rural sectors. - That time, almost 90% of India’s population was based on rural region.

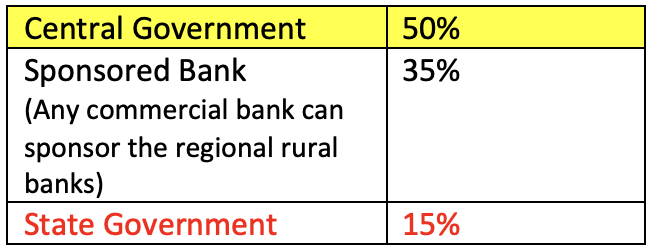

- The share capital of RRBs was subscribed by:

- Authorized working capital of RRBs was one crore and paid up capital was 25 lakh for each bank.

- Main objective of RRBs: Provision of credit and other facilities, especially to small and marginal farmers, agricultural laborers, artisans and small entrepreneurs in rural areas.

- In June 1977, a committee under Prof M.L. Dantwala to evaluate the performance of RRBs; report in 1980 and its recommendation: Establishment of RRBs was very essential for making available credit needs of the farmers and weaker people even in those areas where primary cooperative credit societies were functioning.

- Priority sector lending for RRBs is

75 %. - Presently, there are total 43 RRBs in India.

RBI

- Reserve Bank of India came into existence on

1st April 1935with theRBI act 1934and has been nationalized onJan 1, 1949. Mr. Ospome A. Smith(1st Jan 1935 to 30th June 1937) was the first Governor of RBI.- First Indian governor was C.D. Deshmukh.

- Current Governor: Shakti Kanta Das

- Term: 3 years.

- There are 4 deputy governors.

- H.Q. Mumbai

Functions

- Issue of currency

- Custodian of Forex exchange and maintenance of exchange rate

- Monitoring and regulation of payment system

- Monitoring and regulation of banking and financial system

- Monetary authority and Credit control

SBI

- Bank of Bengal (Est. 1804), Bank of Bombay (Est. 1840) and Bank of Madras (Est. 1843) were merged into Imperial bank of India in

1921 - It was nationalized in

1955.

NABARD

- NABARD is an apex development finance institution fully owned by Government of India. It is the apex banking institution to provide finance for Agriculture and Rural development. Its headquarters is located in

Mumbai, the country’s financial capital. - It is a statutory body established in 1982 under Parliamentary Act -

National Bank for Agriculture and Rural Development Act, 1981. - Started on

12th July, 1982. - Current Chairman:

Dr. G. R. Chintala Raju

History

- The importance of institutional credit in boosting rural economy has been clear to the Government right from its early stages of planning.

- The Reserve Bank of India (RBI) at the insistence of the Government of India, constituted a

Committee to Review the Arrangements for Institutional Credit for Agriculture and Rural Development (CRAFICARD)in1979, under the Chairmanship ofShri B. Sivaraman, former member of Planning Commission. - The Committee’s report (1979) outlined the need for a new organizational device for providing undivided attention, forceful direction and pointed focus to credit related issues linked with rural development.

- It resulted in foundation of NABARD (National Bank for Agriculture and Rural Development) in

1982as a statutory body under Parliamentary act - National Bank for Agriculture and Rural Development Act,1981. - Authorized share capital is 30,000 cr.

- Its initial paid up capital was Rs. 100 cr. contributed with 50: 50 by government of India and Reserve bank of India. Now, it stood at Rs. 14,080 cr. as on 31 March 2020.

- To support Indian Rural economy with credit facility, RBI was apex body before formation of NABARD.

- It resulted in making NABARD as an apex development financial institution in India.

- The NABARD’s role is basically a continuation of the RBI role in the sphere of Agriculture and Rural Development.

- The functions of the 3 institutes of RBI (1) the Agricultural Credit Department (ACD), (2) Rural Planning and Credit Cell (RPCC), (3) and Agricultural Refinance and Development Corporation (ARDC) were transferred to NABARD.

- ACD: RBI provided through its ACD short term refinance to cooperatives.

- RPCC: It was dealing with the Regional Rural Banks (RRBs) since 1979.

- ARDC: RBI set up the

Agricultural Refinance Corporation (ARC)in 1963 to work as a refinancing agency in providing medium term and long-term agricultural credit to support investment credit needs for agricultural development. - In

1975, ARC was renamed as Agriculture Refinance and Development Corporation (ARDC) to give focused attention to credit off-take, development and promotion of the agricultural sector.

Functions

Finance

- Direct Finance

- Rural Infrastructure Development Fund (RIDF)

- NABARD Infrastructure Development Assistance (NIDA)

- Pradhan Mantri Awaas Yojana - Grameen (PMAY-G)

- Swachh Bharat Mission-Gramin (SBM-G)

- Long-Term Irrigation Fund (LTIF)

- Micro Irrigation Fund (MIF)

- Loans to Warehouses, Cold Storage and Cold Chain Infrastructure

- Loans for Food Processing Fund and Food Processing Units in Designated Food Parks

- Dairy Processing and Infrastructure Development Fund (DIDF)

- Credit Facility to Federations (CFF)

- Direct Refinance Assistance to DCCBs for Short-Term Multipurpose Credit (DRA)

- Financing and Developing PACSs

- Supporting Producers’ organizations

- Umbrella Programme for Natural Resource Management (UPNRM)

- Alternative Investment Funds (AIFs)

- Strategic Investments

- Indirect Finance

- Short Term Loans (e.g. KCC)

- Long Term Loans

Supervision

- NABARD conducts statutory inspection of StCBs, DCCBs and RRBs.

Developmental Functions

- Institution Development

- Institutional Development Department of NABARD has been taking several initiatives in association with Government of India (GoI) and Reserve Bank of India (RBI) to improve the health of RFIs viz:

- Regional Rural Banks (RRBs)

- State Cooperative Banks (StCBs)

- District Central Cooperative Banks (DCCBs)

- Primary Agricultural Credit Societies (PACS)

- State Cooperative Agriculture and Rural Development Banks (SCARDBs)

- Primary Cooperative Agriculture and Rural Development Banks (PCARDBs)

- Institutional Development Department of NABARD has been taking several initiatives in association with Government of India (GoI) and Reserve Bank of India (RBI) to improve the health of RFIs viz:

- Marketing intitiatives like promotion of rural haats, rural marts, exhibitions/melas, support geographical indications.

- Financial Inclusion

- Support Watershed Development Programme

- Support research related to agriculture and rural development.

- NABARD has already taken various initiatives in addressing the challenges posed by Climate Change particularly in the areas of agriculture and rural livelihood sectors.

Co-operative in India

- Cooperative society is a basic institution for socio-economic growth of the villagers.

- Basic principle: “Each for all and all for each”.

- Minimum 10 members are required to register a co-operative society.

Principles of Cooperative Society UPPSC 2021

- Principle of Open and Voluntary association

- Principle of democratic organisation

- Principle of service

- Principle of self-help and mutual help

- Principle of distribution of profits and surpluses

- Principle of political and religious neutrality

- Principle of education

- Principle of thrift

- Principle of publicity

- Principle of honorary service

👉🏻 Co-operative movement in the Indian context in the pre-independence era can be classified into four phases:

- Initiation stage (1904-1911)

- Modification stage (1912-1918) …

Become Successful With AgriDots

Learn the essential skills for getting a seat in the Exam with

🦄 You are a pro member!

Only use this page if purchasing a gift or enterprise account

Plan

- Unlimited access to PRO courses

- Quizzes with hand-picked meme prizes

- Invite to private Discord chat

- Free Sticker emailed

Lifetime

- All PRO-tier benefits

- Single payment, lifetime access

- 4,200 bonus xp points

- Next Level

T-shirt shipped worldwide

Yo! You just found a 20% discount using 👉 EASTEREGG

High-quality fitted cotton shirt produced by Next Level Apparel