🚴 Project

Learn about Project

- Project is a specific activity with a specific starting point and a specific ending point intended to accomplish a specific objective.

- It is something which is measurable both in its major costs and returns.

- It will have some geographic location or at least a rather clearly understood area of geographic concentration.

- It will have a specific clientele group which it is intended to reach. It will have a relatively well-defined time sequence of investment and production activities.

Characteristics of Agricultural Projects

- Project is made up of many sub-projects / investments. Ex: Sericulture, palm oil industry, ice factories for fisheries project, construction of 500 dug wells (each well a sub-project).

- Project increases capital intensity of farm enterprise

- Investment costs vary according to natural conditions, market conditions and processing conditions

- The quantum of incremental benefits (income) depends on benefitting area and the level of benefits depends on stage of development farms

- The level of benefits may, however fluctuate from year to year due to weather conditions.

Types of Agricultural Projects

- Water Resource Development Projects: These projects include irrigation projects, ground water projects, projects for land reclamation, drainage projects, salinity prevention and flood control.

- Agricultural Credit Projects: These are called “on-lending projects”. These projects provide credit to the farmers for farm investment for increasing agricultural production, raising their standard of living and the economy as a whole.

- Agricultural Development Projects: These are the projects aimed at improving farm economy of individuals and regional development.

- Agro-industries and Commercial Development Projects: Projects of input, services to farming, projects concerned with processing, storage, market development, projects for fisheries development.

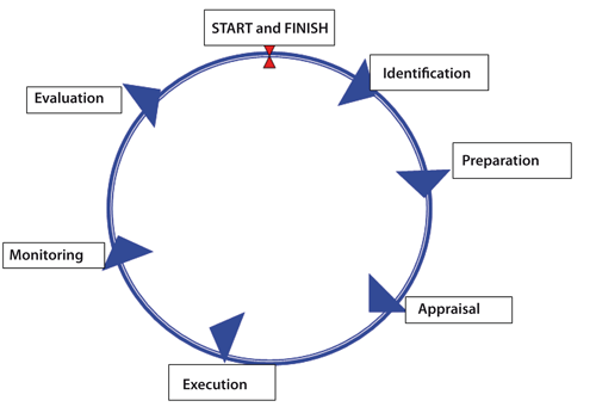

Project Cycle

- There tends to be a natural sequence in the way projects are planned and carried out, and this sequence is often called the “project cycle”.

- The important phases in project cycle are:

-

- Conception or Identification

-

- Formulation or preparation of the project

-

- Appraisal or Analysis

-

- Implementation

-

- Monitoring

-

- Evaluation

-

Project Appraisal and Evaluation Techniques

- When costs and benefits have been identified, priced, and valued, the analyst is ready to determine which among various projects one is to accept and which to reject.

- There is no one best technique for estimating project worth (although some are better than others, and some are especially deficient).

- The techniques of project appraisal can be discussed under two heads viz., (i) Undiscounted and (ii) Discounted.

- Undiscounted techniques: Include

- (a) Payback period

- (b) Value-added

- (c) Capital Output Ratio

- (d) Proceeds per unit of outlay

- (e) Average annual proceeds per unit of outlay

- Discounted measures: Under this

- (a) Net Present Worth (NPW)

- (b) Benefit-Cost Ratio (BCR)

- (c) Internal Rate of Return (IRR)

- (d) N/K Ratio

- (e) Sensitivity analysis are prominent

Undiscounted Measures

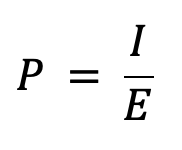

Payback Period

- The payback period refers to the length of time required to recover the capital cost of the project.

- The formula used to work out the payback period is

- P = Payback period of the project in years

- I = Investment of the project in rupees

- E = Annual net cash revenue in rupees

- According to this criterion, the

shorter the periodfor recovery the more profitable is the project. This criterion has two important weaknesses viz.,- It fails to consider earnings after the payback period and

- It does not adequately take into consideration the timing of proceeds.

Discounting Techniques

- Discounting techniques take into account the time-value of money.

- Discounting is essentially a technique by which one can ‘reduce’ the future benefit and cost streams to their present worth.

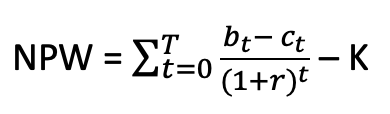

Net Present Worth (NPW)

- It is simply the present worth of the incremental net benefit or incremental cash flow.

- It is the difference between discounted benefits and discounted costs of a project.

- Where,

- NPV = Net present value from project

- bt = benefits ($) received from project in year t

- ct = costs ($) of project in year

- 1/(1+r)t = Discount factor at interest rate r p.a.

- T = lifetime of project, K = initial (capital) outlay at t = 0

- NPW criterion suggests to us to accept all independent projects with a

zero or greater net present worthwhen discounted at opportunity cost. - No ranking of acceptable, alternative independent project is possible with the present worth criterion because it is an absolute and not relative measure.

- A small, highly attractive project may have a smaller net present worth than a larger marginally acceptable project.

- If both have positive NPW then both projects should be undertaken. It is because of lack of funds we cannot undertake both; the complication is that the opportunity cost of capital has been estimated to be too low.

- Then the correct response is to raise the estimate of opportunity cost until we have only the selection of projects with NPW that are zero or positive and for which, in fact, there will be just sufficient investment funds.

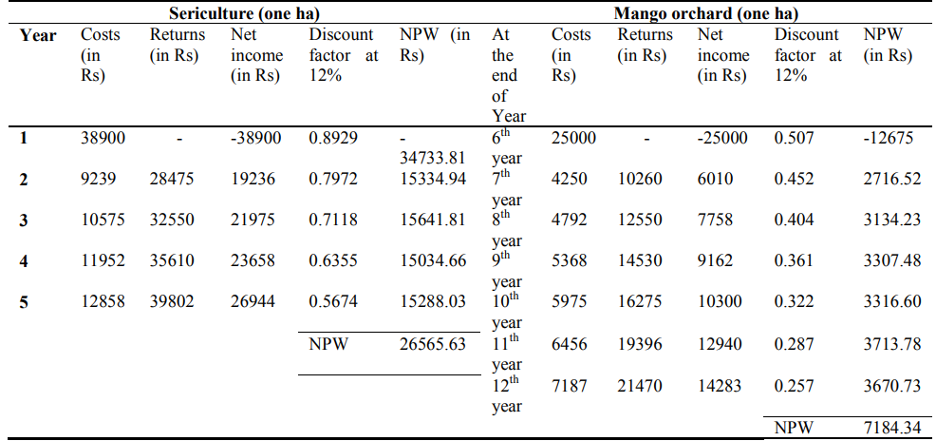

- Example: Estimation of NPW for Two Projects (Hypothetical)

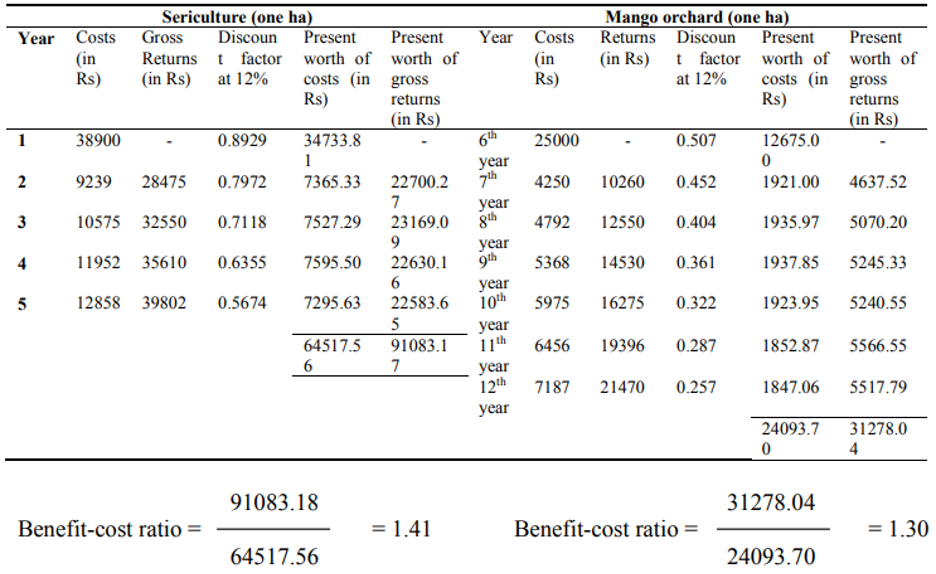

Benefit Cost Ratio Analysis

Benefit-Cost Ratio (BCR): This ratio is obtained when the present worth of the benefit-stream is divided by the present worth of the cost-stream.- Note that the absolute value of BCR will vary depending on the interest rate chosen. The higher the interest rate, the smaller the resultant benefit-cost ratio and, if a higher enough rate is chosen, the benefit-cost ratio will be driven down to less than 1.

- The BCR criterion suggests to us to accept all independent projects with a benefit-cost ratio of

1 or greater, when the cost and benefit streams are discounted at the opportunity cost of capital.

- The benefit-cost ratio discriminates against projects with relatively high gross returns and operating costs, even though these may be shown to have a greater wealth-generating capacity than that of alternatives with a higher benefit-cost ratio.

- Example: Estimation of Benefit-cost Ratio (BCR) for Two Projects (Hypothetical)

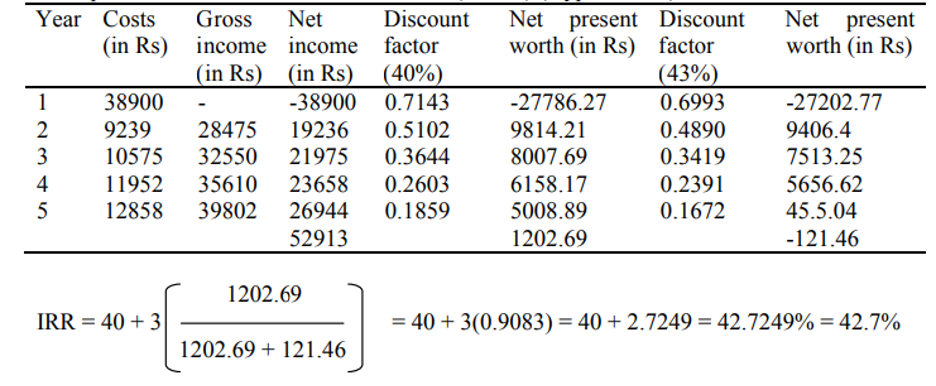

Internal Rate of Return (IRR)

- IRR is the discount rate that makes the NPW of the incremental net benefit-stream or incremental cash flow equal to zero.

- It is the maximum interest that a project could pay for the resources used if the project is to recover its investment and operating costs and still break even.

- It is the rate of return on capital outstanding per period while it is invested in the project.

- IRR criterion suggests to us to

accept all independent projects having an internal rate of return equal to or greater than the opportunity cost of capital. - One cannot simply choose that discount rate which will make the incremental net benefit-stream equal to zero. There is no formula for finding the internal rate of return straightaway. We are forced to resort to a systematic procedure of trial and error to find that discount rate which will make the net present worth of incremental net benefit-stream equal to zero. The most difficult aspect of the trial and error procedure is making the initial estimates. If the estimate is too far from the final result, then several trials will have to be made to find two rates close enough together to permit accurate interpolation (interpolation is the process of finding a desired value between two other values).

- The formula of interpolation is given below:

Best Measureto find worthiness of investment.

- LDR = Lower Discount Rate

- UDR = Upper Discount Rate

- In practice, it is better not to interpolate between intervals greater than about five percent because the wider intervals can easily introduce an interpolation error.

- Example: Estimation of IRR for Sericulture (one ha) (Hypothetical)

Net Benefit-Investment Ratio (NBIR) (N/K Ratio)

- NBIR is simply the present worth of net benefits divided by the present worth of investment.

- To calculate this measure, simply divide the sum of the present worth after the incremental net benefits-stream has turned positive by the sum of the present worth of the negative incremental net benefits in the early years of the project.

- The reason for calculating the net benefit-investment ratio in this manner is that we are interested in an investment measure that selects projects on the basis of return to investment during the initial phases of a project.

- If the net benefit - investment ratio is

1 or greater, when we are discounting at the opportunity cost of capital, choose the project beginning with thelargest ratio valueand proceed until available investment funds are exhausted. - It may be used to rank projects in those instances in which, for one reason or another, sufficient funds are not available to implement all the projects. It, thus, satisfies a frequent request of the decisionmakers that projects be ranked in the order in which they should be undertaken.

- It is suitable for use when there is incomplete knowledge of all the projects. At any given discount rate, we cannot, with confidence, use the net present worth, or the internal rate of return, or the benefit-cost ratio as ranking measures; our criterion tells us only to accept all projects which need the selection criterion for those three measures.

- The net benefit-investment ratio is the only measure of the ones we have discussed that can be used with confidence to rank directly.

Sensitivity Analysis (Treatment of Uncertainty)

- Several times when the project is under execution, certain things go wrong with the project with the result that the desired benefits cannot be achieved within the stipulated time frame.

- For example, the actual execution of the project is delayed or the cost exceeds the original estimated cost (cost over-run). In such cases, the results get fairly changed. Many times, the IRR and NPW thus get reduced or the BCR becomes negative from positive.

- In order to take care of this problem, while the projects are under preparation or under examination, certain assumptions are applied for testing the viability of the project.

- For example, it is at times assumed that there will be a cost over-run by, say, 25% or a reduction in revenues, say, by 10% or a delay in getting the benefits, say, by three years and so on.

- Keeping one or two or all such assumptions in view, the streams of costs and benefits are re-drawn and the figures of costs and benefits are discounted and the NPW, BCR and IRR are re-worked out. This gives a fairly good picture as to what will be the fate of the projects if such problems occur. For the sensitivity analysis, it is very essential to carry out such an exercise in projects where high financial stakes are involved.

- Project is a specific activity with a specific starting point and a specific ending point intended to accomplish a specific objective.

- It is something which is measurable both in its major costs and returns.

- It will have some geographic location or at least a rather clearly understood area of geographic concentration.

- It will have a specific clientele group which it is intended to reach. It will have a relatively well-defined time sequence of investment and production activities.

Characteristics of Agricultural Projects

- Project is made up of many sub-projects / investments. Ex: Sericulture, palm oil industry, ice factories for fisheries project, construction of 500 dug wells (each well a sub-project).

- Project increases capital intensity of farm enterprise

- Investment costs vary according …

Become Successful With AgriDots

Learn the essential skills for getting a seat in the Exam with

🦄 You are a pro member!

Only use this page if purchasing a gift or enterprise account

Plan

Rs

- Unlimited access to PRO courses

- Quizzes with hand-picked meme prizes

- Invite to private Discord chat

- Free Sticker emailed

Lifetime

Rs

1,499

once

- All PRO-tier benefits

- Single payment, lifetime access

- 4,200 bonus xp points

- Next Level

T-shirt shipped worldwide

Yo! You just found a 20% discount using 👉 EASTEREGG

High-quality fitted cotton shirt produced by Next Level Apparel