🛠 Tools for Farm Business

Learn Tools for Farm Business

Farm business analysis

- The subject of farm business analysis can be a useful tool. The subject of farm business analysis is dealt with the under different names, i.e. Farm Accountancy, Farm Book Keeping and Farm Inventory Analysis.

- Farm Accountancy is defined as the art as well as science of recording in books the business transactions in a regular and systematic manner, so that their nature, extent and financial effects can be readily ascertained at any time of the year.

- Farm Book Keeping is known as a system of records written to furnish a history of the business transactions, with special reference to its financial side (Adams).

- Farm accounting thus, in the usual sense is an application of the accounting principles to the business of farming.

Farm Inventory Analysis

- Farm inventory is a list of all the physical properties of a business along with their value at a specified date.

- It is a complete list of farmer’s assets with their valuation at a point of time.

Assets

- As asset is a physical property or intangible right owned by a business or an individual that have a value. Assets are classified into the following types:

- Current Assets: These consists of cash in hand, bills recoverable, crops, feed on hand, livestock that is or will shortly be in condition for sale

- Intermediate or Working Assets: They are more liquid than fixed assets, such as farm machinery and equipment, etc. for example, breeding and producing livestock. These resources will ordinarily be worn out in the normal process of business.

- Long term assets or Fixed Assets: An asset that is permanent or will be used continuously for several years. Ex. Land, buildings and other long lived inventory structures.

Liabilities

- The debt or amount of money owned by an individual, partnership or corporation to others are called liabilities. Liabilities are commitments of the farmer. This may be in the form of loans, promissory notes, material bought on credit etc. Liabilities are of three types:

- Current liabilities: Debts that must be paid in the short term or in very near future. Examples: Crop loans, other loans, costs of maintenance loans etc.

- Intermediate liabilities: These loans are due for the repayment within a period of

two to five years. Example: livestock loans, machinery loans etc - Long term liabilities: The duration of loan repayment is

five or more years. Example: Tractor loan, orchard loan, land development loan etc.

Balance Sheet (Net worth Statement)

- The balance sheet indicates an account of total assets and total liabilities of the farm business revealing the financial solvency of the business.

- More specifically it is a statement it is a statement of the financial position of a farm business at a particular time, showing its assets, liabilities and equity.

- If the assets are more than liabilities it is called

net worth or equityand its converse is known asnet deficit. - The typical balance sheet shows assets on the

left sideand liabilities and equity on the right side. - Both sides are always in balance hence the name balance sheet.

- Net worth is placed on the

right side. (So that both side will be in balance)

Test Ratios

- The test ratios viz, current ratio, intermediate ratio, net capital ratio, quick ratio, current liability ratio, debt-equity ratio and equity-value ratio can be derived from the balance sheet.

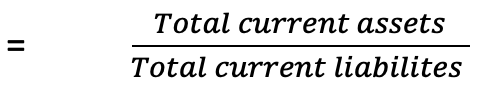

Current Ratio

- It shows liquidity within one year’s time.

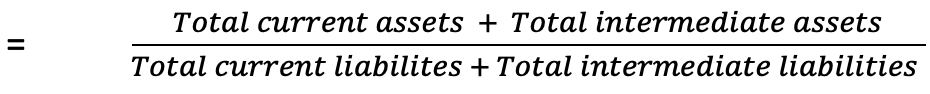

Intermediate ratio or working ratio

- It shows liquidity position of the farm business over an intermediate period of time, ranging from 2 to 5 years.

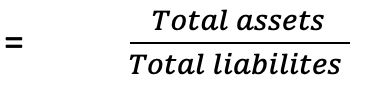

Net capital ratio

- It shows long term liquidity position of the farmers. acid

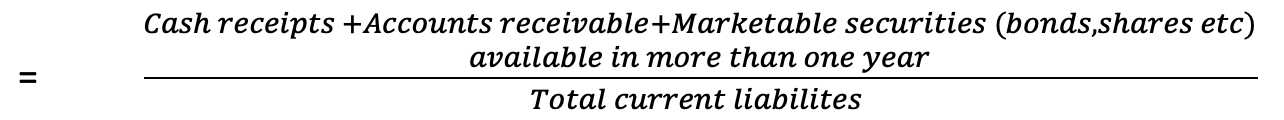

Acid test ratio or Quick ratio

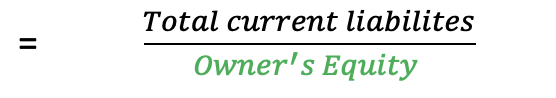

Debt-equity ratio (Leverage Ratio)

- With increase in leverage, risk in agri-business increases.

Income Statement or Profit and Loss Statement

- It is summary of receipts and gains minus expenses and losses during a specified period. It is prepared for entire farm for one agricultural year.

Operational efficiencyis studies in Income statement; which is not studied in balance sheet.

Receipts

- They mean the returns obtained from the sale of crop produce and other supplementary products like milk and eggs, wages, gifts etc. Gain in the form of appreciation in the value of assets is also included in the receipts.

- However, returns from the sale of capital assets, such as livestock, machinery, farm buildings, etc. are not included because such return/income are not really obtained during the period.

Expenses

- Operating and fixed costs are recorded here. Losses in the form of depreciation on the asset value fall under the expenditure items.

- However, the amounts incurred on the purchase of capital assets are not considered.

Net Income

Net Cash Income

- It gives the position of cash receipts minus cash expenses only during the period for which income statement is prepared.

Net Operating Income

- It is arrived at by deducting operating expenses from the gross income. Fixed costs are not given any consideration. Operating expenses include crop loans.

Net Farm Income

- Net farm income equals net operating income less fixed costs.

- Compared to net cash income and net operating income, it is relatively a better measure of assessing the performance of a farm.

- It is the return accrued to owned capital and family labour employed.

Financial Test Ratios

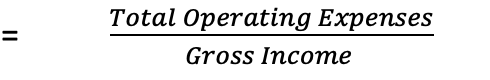

Operating Ratio

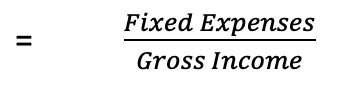

Fixed Ratio

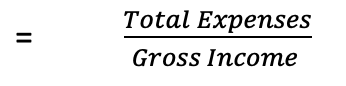

Gross Ratio

- This can be called

input-output ratio.

Capital Turn Over Ratio

Rate of Return on Investment

Management Ratios

- Management Return: It is derived by deducting unpaid family labour wages and interest on owned capital from net farm income.

- Crop yield and value

- Livestock Income

- Gross Income per man

- Gross Income per rupee investment

Farm business analysis

- The subject of farm business analysis can be a useful tool. The subject of farm business analysis is dealt with the under different names, i.e. Farm Accountancy, Farm Book Keeping and Farm Inventory Analysis.

- Farm Accountancy is defined as the art as well as science of recording in books the business transactions in a regular and systematic manner, so that their nature, extent and financial effects can be readily ascertained at any time of the year.

- Farm Book Keeping is known as a system of records written to furnish a history of the business transactions, with special reference to its financial side (Adams).

- Farm accounting thus, in the usual sense is an application of the accounting principles to the business of farming.

Farm Inventory Analysis

- Farm inventory is …

Become Successful With AgriDots

Learn the essential skills for getting a seat in the Exam with

🦄 You are a pro member!

Only use this page if purchasing a gift or enterprise account

Plan

Rs

- Unlimited access to PRO courses

- Quizzes with hand-picked meme prizes

- Invite to private Discord chat

- Free Sticker emailed

Lifetime

Rs

1,499

once

- All PRO-tier benefits

- Single payment, lifetime access

- 4,200 bonus xp points

- Next Level

T-shirt shipped worldwide

Yo! You just found a 20% discount using 👉 EASTEREGG

High-quality fitted cotton shirt produced by Next Level Apparel