₹ Cost Cocepts

Learn basics of Cost Cocepts

Types of Costs

Nominal Costs or Money Costs

- Nominal costs of production refer to per unit cost of production of output

at current market prices.

Real Costs

- When the costs of inputs and input services are expressed

at constant pricesthey become real costs.

Opportunity/Alternate Cost

- Opportunity cost is

the value of return sacrificed or foregone form the next best alternative activity. - For Example, a farmer raises paddy on his farm instead of maize. It means the farmer utilizes the other opportunity by giving up the first alterative. Here the opportunity cost of raising paddy will be the amount of maize sacrificed in the process. Therefore, in modern economics the real cost is presented as opportunity cost or Alternative Cost.

- In farming farmers don’t have to pay for their owned resources, viz. family labour, owned bullock labour, owned machinery, owned seed etc. But still in the cost analysis the value of these owned resources are considered on the basis of opportunity cost.

- The concept of opportunity cost was introduced by

J.S. Mill. - Opportunity cost of abundance and unlimited resources is

zero. - Opportunity cost of free goods is

zero.

Economic Costs

Economic costs include two types of costs:

Explicit costsinclude payments made by the entrepreneurs for purchasing and hiring of inputs and input services. They are also calledpaid out costsorcash costs.- Cost of self-owned and self-employed resources are known as

implicit costs. - In accounting only explicit costs are included so called

accounting cost. - Both Explicit cost and implicit cost together constitute Economic cost.

Economic Cost = Accounting (Explicit) Cost + Implicit Cost

Deflated Costs

- Costs if deflated by

general price indexare called deflated costs. By doing so the effect of inflation in an economy is taken out. - Example: Real cost of commodities.

Social Costs

- These are also called as

externalities. - Social cost name given by

Ronal Coase. - Firms incur both implicit and explicit costs in the production of goods and services. Their sum constitutes total cost of production. These costs we name as private costs.

- But from the point of view of society, these firms will give rise to some additional costs to the society in the form of environmental degradation, water, air or noise pollution, etc. in the areas where goods are produced by the private firms. Such costs are called social costs.

Negative externalitiesis one where social costs out weight social benefits.

Separable Costs and Common Costs

Separable costsare the costs which can exclusively be attributed to production of output separately.Common costsare those which cannot be separated to the production of the output. So they are called joint costs. The costs are involved in the production of several products.- For Example: electricity generation, ground water use etc.

Historical Costs and Replacement Costs

Historical costsare the costs involved in the purchase of durable goods like land, building, machinery, equipment, etc. Purchase price of the asset should be considered as price of the asset and hence it is considered as historical cost in analysis.Replacement costrefer to the difference between the purchase price of the asset and the current price of the same asset. Suppose a tractor is purchased 10 years ago at a price of Rs 1,50,000 but its present price is say Rs 2,50,000 the difference of Rs 1,00,000 is the replacement cost.

Establishment Costs

- Construction of plant in any business activity entails some costs. Such construction cost are called establishment costs in the business analysis.

- They are also called

first phase costs.

Cost Concepts

- Cost if the

function of output. - In short run, pricing and output decisions are based on short run cost curves, while in long run, long run cost curves have crucial implications for development and growth of the firm and investment policies of the firm.

Fixed Cost (FC)

- Such cost does not change in magnitude as the amount of the production process changes and are incurred even when production is not under taken.

- These cost remain invariant in the short run but in the long run there are no fixed costs as all the inputs can be varied.

- These are also called

Overhead CostorSunk CostorIndirect Costand may be cash or non-cash fixed costs. - The examples of fixed cash cost are Land taxes, Interest, Insurance premiums, annually hired labour etc.

- Whereas the non-cash fixed costs are depreciation on capital investment, cost of family labour and costs of management, machinery equipment, and interest on fixed capital.

- The summation of all these costs is called

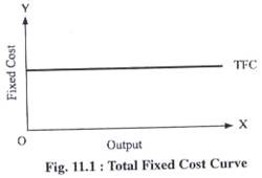

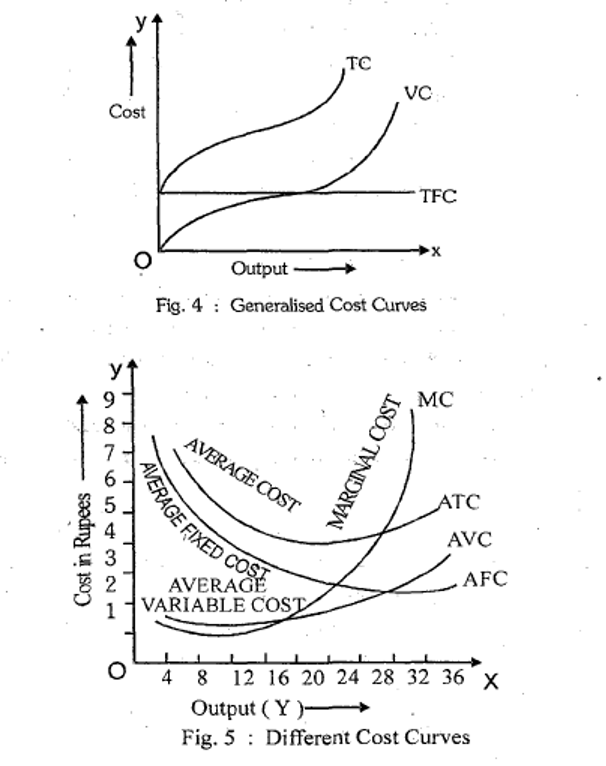

Total Fixed Costs (TFC). - TFC is a horizontal straight line parallel to

X-axis.

Variable Cost (VC)

- Variable costs as per definition vary with the level of output.

- These include costs of raw materials, labour, power, repairs, maintenance charges of machinery, etc.

- These are also known as

Working Costs,Operating Costs,Direct Costs,Prime Costs,Circulating CostsandRunning Costs. - These are

second phase costs. - Examples of variable cost are cost of seed, feed, fertilizer, water, labour hired occasionally, interest on borrowed capital, current repair replacement, diesel etc. Here farming expenses are the function of farm output.

Farming Expenses = f (farm output)

- The summation of these costs refer to

Total Variable Costs (TVC). - Graphically TVC as inverse

S shape.

Total Cost (TC)

- TC = Total Fixed Cost + Total Variable Cost

- = TFC + TVC

- = FC + VC

- = Explicit Cost + Implicit Cost

- In the beginning total production cost is lower but increases gradually.

- Shape of curve is similar to TVC.

Average Variable Cost (AVC)

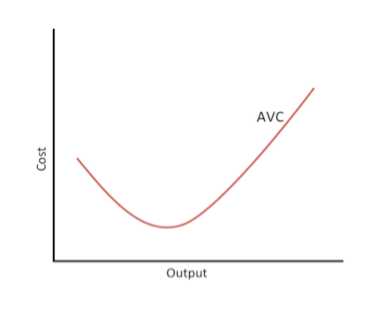

- It is the amount spent on the variable inputs to produce a unit of output. Algebraically it is expressed as:

AVC = (Total Variable Costs)/Output = TVC/Q

- When a small amount of output is produced, cost of variable input per unit of output becomes very high. This is to say in other words, that productivity of variable input increases when greater amounts are used in the production of the commodities due to economies of scale.

- This causes AVC to have

‘U’ shape(parabolic) when it is graphed. - When it is ‘U’ shaped it becomes reciprocal of Average Physical Product (APP) curve.

AVC falls to minimum levelat the output level whereAPP is maximum. - There after due to production of greater amount of output, AVC rises again and becomes

verticalat certain level of maximum output.

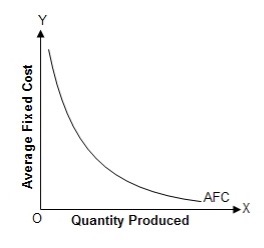

Average Fixed Cost (AFC)

- It is cost of fixed resources or inputs required for producing one unit of output and it is given by the formula as:

- AFC curve is declining with the increased output because TFC is constant. Due to this it is continuously falling up to its maximum output.

- It is having the shape of

hyperbola.

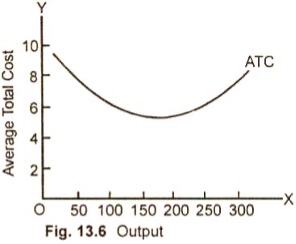

Average Total Cost or Average Cost (ATC or AC)

- When the total costs are divided by output, we get ATC.

U shapedcurve.

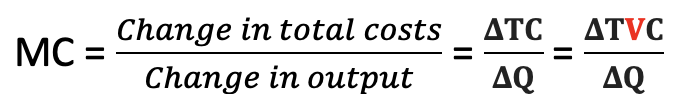

Marginal Cost (MC)

- It is the change in the total cost due to change in output.

- Marginal Fixed Cost is

always zerobecause fixed cost does not change with the change in output. Therefore Marginal Cost is necessarilymarginal variable costand the change in fixed cost (FC) will not affect marginal cost (MC). - For example, the cost of producing few more vegetables by farming a given amount of land more intensively, is not affected by the amount of rent paid for the fixed amount of land.

- Marginal Cost (MC) is independent of the size of fixed cost.

‘U’ shapedcurve.- When

MPP is maximum MC is minimum. - MC curve is declining when MPP curve is increasing; hence there is an inverse relationship between MPP and MC.

- When

MPP is zero MC becomes vertical. - MC curve intersects AVC and AC at their

minimum points.

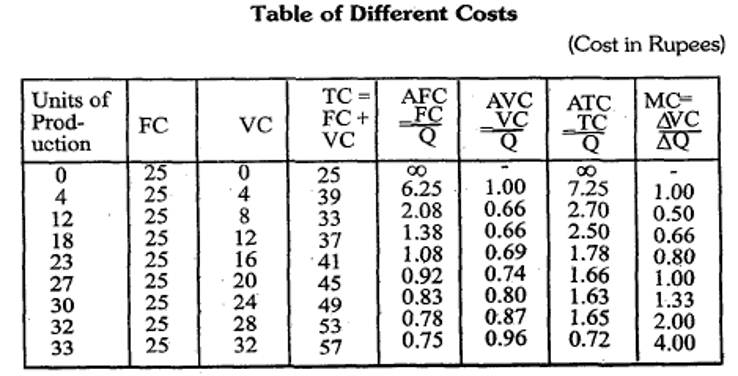

👉🏻 Three points are inferred, from the above table:

- Fixed Costs are the same at the whole production level.

- Variable cost changes with the change in production level.

- Total Cost and Variable Cost increase with the increase in production.

👉🏻 The inference may be drawn from the above different cost curve:

- AFC: is continued to decline and never shows upward movement because the input investment after the achievement of maximum product becomes irrational.

- AVC: with the rise in production, AVC firstly declines reaches the lowest point at highest APP and again increases.

- ATC: The trend of ATC is same as of AVC but the lowest point of ATC is after than AVC.

- MC: With the increase in output, MC first falls due to more efficient use of the variable factors of production and then it slopes upwards due to less efficient use of the variable factor.

- When ATC is falling MC is below. When ATC is rising MC is above.

- Vertical distance between ATC and AVC curve is AFC.

Cost concept in farm Management

- The cost is the outlay of funds for productive services. There are many cost concepts used in agricultural economics and farm management i.e. Cost A1, Cost A2, Cost B, Cost C; working or variable or operational cost and fixed costs; Explicit and Implicit cost; opportunity cost; labour costs etc.

- Cost A1: Consists of following 16 items of costs:

- Value of hired human labour (Permanent & Casual)

- Value of owned bullock labour

- Value of hired bullock labour

- Value of owned machinery

- Hired machinery charges

- Value of fertilizers

- Value of manure (Produced on farm and purchased)

- Value of seed (both farm-produced and purchased)

- Value of insecticides & fungicides

- Irrigation charges (both of the owned & hired tube wells, pumping sets etc.

- Canal-water charge

- Land revenue, cesses and other taxes

- Depreciation on farm implements (both bullock drawn & worked with human labour)

- Depreciation on farm buildings, farm machinery and irrigation structures.

- Interest on the working capital

- Miscellaneous expenses (wages of artisans, cost of ropes & repairs to small farm implements)

- Cost A2 = Cost A1 +

Rent paid for Leased in Land - Cost B1 = Cost A1 +

interest on value of owned fixed capital assets (excluding land) Cost B2= Cost B1 + rental value of owned land (net of land revenue) and rent paid for leased in land- Cost C

1= Cost B1+imputed value of family labour - Cost C

2= Cost B2+imputed value of family labour - Cost C2* = Cost C2 + Additional value of human labour based on use of higher rate. i.e. Statutory Wage rate or the actual market rate. This is an intermediate Concept.

- Cost C3 = Cost C2* + 10 percent of cost C2* to account for managerial input of the farmer

- It means cost C consists of 20 items viz.

- Cost C = Cost A1 (having 16 items) +

- Rent Paid for Leased land +

- Imputed value of owned land (less land revenue paid there upon) +

- Imputed interest on owned fixed capital (excluding land) +

- Imputed value of family labour

- Net Income = Gross Return - Cost C

- Cost of Production = Cost C /Output

Cost of Production (CoP)

- This cost is calculated on Rupees per

Quintal.

Cost of Cultivation (CoC)

- This cost is calculated on Rupees per

Hectare. AFO 2017

Types of Costs

Nominal Costs or Money Costs

- Nominal costs of production refer to per unit cost of production of output

at current market prices.

Real Costs

- When the costs of inputs and input services are expressed

at constant pricesthey become real costs.

Opportunity/Alternate Cost

- Opportunity cost is

the value of return sacrificed or foregone form the next best alternative activity. - For Example, a farmer raises paddy on his farm instead of maize. It means the farmer utilizes the other opportunity by giving up the first alterative. Here the opportunity cost of raising paddy will be the amount of maize sacrificed in the process. Therefore, in modern economics the real cost is presented as opportunity cost or Alternative Cost.

- In farming farmers don’t have to pay for their owned …

Become Successful With AgriDots

Learn the essential skills for getting a seat in the Exam with

🦄 You are a pro member!

Only use this page if purchasing a gift or enterprise account

Plan

Rs

- Unlimited access to PRO courses

- Quizzes with hand-picked meme prizes

- Invite to private Discord chat

- Free Sticker emailed

Lifetime

Rs

1,499

once

- All PRO-tier benefits

- Single payment, lifetime access

- 4,200 bonus xp points

- Next Level

T-shirt shipped worldwide

Yo! You just found a 20% discount using 👉 EASTEREGG

High-quality fitted cotton shirt produced by Next Level Apparel