🌎 Maco Economics

Learn about Maco Economics

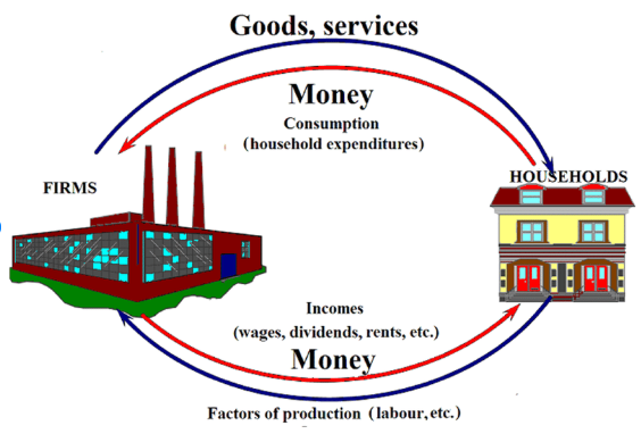

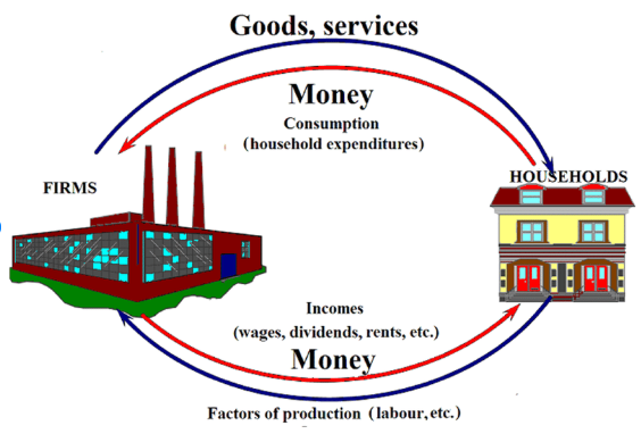

- In every economy there is always a circular flow (movement) of resource services (i.e. services of land, labour, capital and enterprise) from the household to firms and the reverse movement of goods and services from the firms to the households. This is depicted in the diagram given below. The inner circuit shows the real flows would take place only in barter economy where goods and services are exchanged for goods and services. But in the modern economy where use of money as medium of exchange is widely adopted.

- Households supply the resource services or factors to firms and receive in return payments in terms of money for goods and services they want. The firms sell goods and services for money and use the money so received to pay the households for their supply of resource services. Thus labour gets Wages; capital gets interest; land gets rent and enterprise gets profits all in terms of money, this circular flow of money also known as

Wheel of Wealth. - This flow of money is not continuously at steady level. It may contract or expand when depression and prosperity occur, respectively in an economy. The diagram explains circular flow of closed economy where savings and role of Government is totally absent.

Definition of National Income

“National Income is that part of objective income of the community, including income derived from abroad, which can be measured in money” - Pigou.

Concepts of National Income

The important concepts of National Income are:

- Gross Domestic Product (GDP)

- Gross National Product (GNP)

- Net National Product (NNP) at Market Prices

- Net National Product (NNP) at Factor Cost or National Income

- Personal Income

- Disposable Income

Gross Domestic Product (GDP)

- Gross Domestic Product (GDP) is

the total market value of all final goods and services currently producedwithin the domestic territory of a country in a year. - It measures the market value of annual output of goods and services currently produced. This implies that GDP is a monetary measure.

- All goods and services produced in any given year must be counted only once so as to avoid double counting. It ignores the transactions involving intermediate goods.

- Double counting has the effect of over-estimating national income.

👉🏻 Things not included in GDP

- Services which are rendered freely are not included in GDP. Like parents upbringing their children.

- The transactions relating to the goods which are not currently produced are not taken into account.

- Sale and purchase of old goods and of shares, bonds, assets of the business units etc. are not included because they do not add anything to the national produce as they are simply transferred from one to another.

- Old age pensions, unemployment allowances etc. (transfer payment) are also not considered, as they do not provide any service.

- The changes in the value of the capital assets as a result of changes in the market prices are also not taken into account, as they have nothing to do with the current production.

Gross National Product (GNP)

- Gross National Product is the total market value of all final goods and services produced in a year. GNP includes net factor income from abroad whereas GDP does not. Therefore,

GNP = GDP + Net factor income from abroad

- Net factor income from abroad = factor income received by Indian nationals from abroad – factor income paid to foreign nationals working in India

NNP or Net National Product (NNP) at Market Price

- To estimate the NNP,

depreciationis deducted from GNP. NNP therefore is the market value of all final goods after duly accounting for the depreciation. - In other words, NNP is the net money value of final goods and services produced at current prices in a year in a country.

NNP = GNP – Depreciation or Personal Consumption expenditure on goods and services (C) + Net Domestic Private Investment (I) + Government Expenditure on Goods and Services (G) + Net Exports (X – M)

- Depreciation is the consumption of fixed capital or fall in the value of fixed capital due to wear and tear.

- If nothing is given then consider at market price.

Net National Product (NNP) at Factor Cost (National Income)

- NNP at factor cost or

National Incomeimplies the sum of all income earned by resources suppliers for their contribution of land, labour, capital and entrepreneurial ability, which go into the net production in a year. - The difference between national income at factor cost and NNP at market prices arises due to the indirect costs and subsidies which pushes the NNP at market prices higher than NNP at factor cost.

NNP at Factor Cost = NNP at Market Price – Indirect Taxes + Subsidies

Personal Income

- Personal income is the sum of all

incomes actually received by all individuals or households during a given year. - National income differs from personal income in the sense that national income is earned by factors of production.

- Social security contributions, corporate income taxes and undistributed profits are earned but not received by the individuals.

Transfer paymentslike old age pensions, unemployment dolls, interest in public loan etc. are not currently earned but received by the individuals. So to arrive at personal income, we have to subtract social security contributions, corporate income taxes and undistributed corporate profits from national income which are earned but not received and add incomes received but not currently earned.

Personal Income = National Income – Social Security contributions – corporate income taxes – undistributed corporate profits + transfer payments

Disposable Income

- It is the amount of money

available with the private individuals to spend. - From personal income if we deduct personal taxes like income taxes, personal property taxes etc. what remains is called disposable income.

Disposable Income = Personal Income – Personal Taxes

- Disposable Income can either be consumed or saved. Therefore,

Disposable Income = Consumption Expenditure + Saving

Measurement of National Income

👉🏻 Production generate incomes which are again spent on goods and services produced. Therefore, national income can be measured by three methods:

- Output or Production Method

- Income Method, and

- Expenditure Method

Output or Production Method

- This method is also called the

Value-added method. This method approaches national income from the output side. Under this method, the economy is divided into different sectors such as agriculture, fishing, mining, construction, manufacturing, trade and commerce, transport, communication and other services. Then, the gross product is found out by adding up the net values of all the production that has taken place in these sectors. - It is always difficult to distinguish between intermediate products (raw material, fuel etc.) and final good (machinery, equipment etc.) as raw material is an intermediate product form one industry and final product for the other industry. So to overcome this problem the value of the intermediate goods used in a manufacturing industry should be deducted from the value of the final goods. The difference that is arrived at is called value addition. If the same procedure is applied for all the industries in the economy, we can find out the GNP by value added method.

Income Method

This method approaches national income from the distribution side. According to this method, national income is obtained by summing up of the incomes of all individuals in the country. Thus, national income is calculated by adding up following items:

- ✅ Wage and Salaries: The wage and salaries earned by the employees are identified. These include contributions by the employees towards provident fund, insurance, etc.

- ✅ Rent: Different rent earned by the individuals are taken into account. These rents represents rent of land, houses, factory, shops, etc. and also estimated rates of these, if the owners use them.

- ✅ Interest: The interest earned by the individuals from various sources is found out. To this, interest on the owned funds is added.

- ✅ Incomes of Non-company Business: These are the incomes earned by individual proprietors, partners, self-employed persons etc.

- ✅ Corporate Profits: Corporate profits used in the calculation of GDP are equal to the sum of corporate profits, taxes plus dividends paid to the shareholders plus undistributed profits.

- ✅ Indirect Taxes: Indirect taxes like sales tax and excise duty are levied in the commodities. In fact price per unit of a commodity incudes these indirect taxes. But revenue from these taxes get credited to the Government but not to the factors of production. The income derived through these sources should be added to the national income.

- ✅ Depreciation: During the process of production, machines, and other capital investment depreciate for which the manufacturing firms make allowance. Since this amount is not received by the factors of production, it is included in GDP.

- ⛔️ Transfer payments: Payments received by the individuals as pension, unemployment allowance etc. are called as transfer payments. These are received by the people for not doing any work, so these should be deducted from GNP. Now GDP through income method can be expressed using the following formula:

GDP = Wages and salaries + Rents + Interests + Profits of unincorporated firms + Dividend + Undistributed corporate profits + Corporate taxes + Indirect taxes + Depreciation – Transfer payments

Expenditure Method

- This method arrives at national income by adding up all the expenditure made on goods and services during a year. Expenditure includes personal consumption expenditure, gross domestic private investment, net foreign investment and Government expenditure on goods and services.

Personal Consumption Expenditure (C)

- It includes all types of expenditure on personal consumption by the individuals of a country. It includes expenses on durable goods (Scooters, watches, televisions, refrigerators etc.) and expenditure on non-durable goods or consumable articles (food, clothing etc.) as also the expenditure incurred on services of all kinds (teachers, doctors, lawyers, transportation etc.).

- It includes expenditure on intermediate goods. Expenditure on house is treated as investment expenditure rather than consumption expenditure.

Gross Domestic Private Investment (I)

- It is gross investment in the economy. It includes private investment on capital and producer goods like buildings, machinery, equipment, etc. These investment activities pertain to business firms. It includes capital or investment goods needed not only to replace the existing depreciated capital goods, but also the capital goods required to increase the society’s production of goods and services.

- The term investment should reflect the real investment but not the financial investment. If an individual buys an old machinery, it may be financial investment, but not real investment, for it was included in the GDP of that year (the year of purchasing the new machinery). Hence, purchase of real investment goods such as machinery, equipment etc. produced during the year is only considered.

- Further investment does not include, mere financial transfer such as purchase of existing old stocks and shares in the stock exchange, since it does not allow any new production.

Net Foreign Investment (X – M)

- In an economy, the entire production may not be sold within the country and part of it is exported to other countries.

- Similarly, the country imports some finished goods from other countries during the year.

- The difference between the value of exports and that of imports should be worked out. If the difference is positive, it should be added to the other items of expenditure and it should be deducted from other items of expenditure, if the difference is negative.

Government Expenditure on Goods and Services

- The Central and State Governments purchase consumer goods as well as investment goods for their own enterprises. Apart from this, the Government spends on defense and police as well.

- Government also spends sizable amounts on transfer payments (social security payments). However, these payments are not included in GDP, for these payments are not the ones for currently produced goods and services.

GDP = C + I + (X – M) + G

Difficulties in the Measurement of National Income

- Prevalence of non-monetized transactions in agriculture still lot of product does not come into the market. It consumed at farm level.

- Illiteracy - Due to illiteracy it is not possible to keep regular account.

- Occupational specialization is incomplete.

- Lack of adequate statistical data.

- Estimation of value of inventories i.e. raw material is very difficult.

- Estimation of depreciation on capital goods and avoiding double counting is too much difficult.

Use of National Income data

It is very useful to measure economic welfare, determine standard of living of a community, similarly to assess economic development and for comparison purpose the national income is must.

India

- GDP in India is calculated by

Central Statistical Organisation (CSO)and base year for calculation of GDP is2011-12. - Gross Domestic Product (GDP) gives the economic output from the consumers’ side. It is the sum of private consumption, gross investment in the economy, government investment, government spending and net foreign trade (the difference between exports and imports).

GDP = Private Consumption + Gross Investment + Government Investment + Government Spending + (Exports - Imports)

- India is

sixth largest economyin the world (USA > China > Japan > Germany > U.K.) with GDP of $ 2.94 Trillion. - In 2015, the Central Statistics Office (CSO) did away with GDP at factor cost and adopted the international practice of GDP at market price and the Gross Value Addition (GVA) measure to better estimate economic activity.

GDP at market price = GDP at Factor Cost + Indirect Taxes – Subsidies

Gross Value Added (GVA)

- Gross Value Added (GVA) is a measure of total output and income in the economy. It provides the rupee value for the number of goods and services produced in an economy after deducting the cost of inputs and raw materials that have gone into the production of those goods and services.

- It also gives sector-specific picture like what is the growth in an area, industry or sector of an economy.

- At the macro level, from a national accounting perspective, GVA is the sum of a country’s GDP and net of subsidies and taxes in the economy.

Gross Value Added = GDP + Subsidies on Products - Taxes on Products

Comparison Between GVA and GDP

- While GVA gives a picture of the state of economic activity from the producers’ side or supply side, the GDP gives the picture from the consumers’ side or demand perspective.

- GVA is considered a better gauge of the economy. GDP fails to gauge real economic scenario because a sharp increase in the output, only due to higher tax collections which could be on account of better compliance or coverage, rather than the real output situation.

- A sector-wise breakdown provided by the GVA measure helps policymakers decide which sectors need incentives or stimulus and accordingly formulate sector-specific policies.

- But GDP is a key measure when it comes to making cross-country analysis and comparing the incomes of different economies.

- In every economy there is always a circular flow (movement) of resource services (i.e. services of land, labour, capital and enterprise) from the household to firms and the reverse movement of goods and services from the firms to the households. This is depicted in the diagram given below. The inner circuit shows the real flows would take place only in barter economy where goods and services are exchanged for goods and services. But in the modern economy where use of money as medium of exchange is widely adopted.

- Households supply the resource services or factors to firms and receive in return payments in terms of money for goods and services they want. The firms sell goods and services for money and use the money so received to pay the households for their supply of resource …

Become Successful With AgriDots

Learn the essential skills for getting a seat in the Exam with

🦄 You are a pro member!

Only use this page if purchasing a gift or enterprise account

Plan

- Unlimited access to PRO courses

- Quizzes with hand-picked meme prizes

- Invite to private Discord chat

- Free Sticker emailed

Lifetime

- All PRO-tier benefits

- Single payment, lifetime access

- 4,200 bonus xp points

- Next Level

T-shirt shipped worldwide

Yo! You just found a 20% discount using 👉 EASTEREGG

High-quality fitted cotton shirt produced by Next Level Apparel