💳 Public Revenue

Learn about Public Revenue

- The expenditure of the Government has to be met from the revenue that is accrued by the Government from various sources.

Sources of revenue

The functions of Government are very important and extensive which require heavy expenditure. Government has to undertake important functions like defense (internal and external), Social welfare, education, health, industry, agriculture. For all of these a huge amount of funds is required.

The major sources of revenue for the Government are in the form of Taxes and Prices while the minor sources are Fees, Special assessment, Escheat, Grants, gifts donations, tributes and indemnities.

Major Sources

- Tax: A compulsory contribution imposed on the public.

- Price: A price is the payment for a service of business character, for example, charges for travelling on railways, bus charges, electricity etc. The price is different from fee. The fee is for public interest. You can escape a price by not purchasing the said service / commodity.

Minor Sources

- Fee: It is also a compulsory payment but made only by those who obtain a definite service in return from the government. The fee covers the part of the cost of service provided to the consumer / client. The license fee, however, is much more than the cost of service and there is not much of a positive service in return.

- Special Assessment: This is a compulsory contribution, levied in proportion to the special benefit derived, to defray the cost of a specific improvement to property undertaken in the public interest. Suppose the government build a road or bridge or provide mass transport system or makes suitable sewerage and water supply arrangements, all the property will appreciate in value. The State has the right to levy a special tax on the owners of land or property known as “special assessment”.

- Rates: They are levied by the local bodies, municipalities and district boards for local purposes. They are generally levied on immovable property of the residents, but not necessarily for any special improvements effected or special benefits conferred.

- Escheat: It refers to the property that is claimed by Government of the deceased without successors or will.

- Tributes and indemnities: Tributes are paid by the conquered countries. Indemnities are paid for any damage done to the country by way of war of aggression.

- Grants, gifts and donations: Grants are the funds provided by the apex organizations to its sub-ordinate organizations. For Example: ICAR grants to SAU’s. Gifts are those funds granted by the foreign countries during natural calamities etc., Donations are for specific purposes like educational buildings etc., funded by individuals.

Tax

Seligman defines tax as a compulsory contribution from a person to the state to defray the expenses incurred in the common interest of all, without reference to special benefit conferred.

Method of Taxation

Proportional Tax

- A proportional tax is one in which, whatever the size of income,

same rate or percentageof tax is charged.

Progressive Tax

- On the contrary, progressive tax refers to the tax system in which

the rate of tax increases with the increase in income. - It is based on the principle “higher the income, higher the tax”.

- It is based on the law of diminishing marginal utility of money.

Regressive Tax

- A tax is said to be regressive when its burden falls more heavily on low-income earners / poor than the high-income earners / rich.

- It is opposite of progressive tax.

Degressive Tax

- A tax is called degressive when the higher income does not make a due sacrifice, or when the burden imposed on them is relatively less.

- This tax may be progressive up to a certain limit beyond which a uniform rate is charged.

Classification of Tax

Specific Tax

- A specific tax is according to the amount/ weight of the commodity.

Ad volarem Tax

- An advolarem tax is according to the value of a commodity.

- Example: Stamp duty

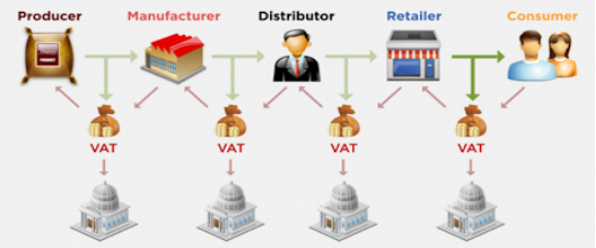

Value Added Tax (VAT)

- Value Added Tax (VAT) is levied on the value of each of the processes carried out by a businessman.

- Means it is applied to all stages between production and final stage.

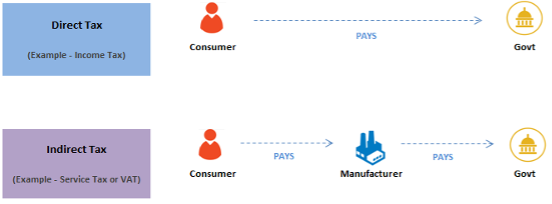

Direct Tax

- Direct tax is one which is paid by the person on whom it is charged.

- Impact and Incidence are on the same person.

- Direct tax are paid on income levels.

- The examples of direct taxes are income tax, wealth tax, etc.

Indirect Tax

- Indirect taxes are commodity taxes. They are paid by one person and its burden is fallen on other, generally the consumer.

- Impact and Incidence are on the different person.

- Indirect tax are paid on outlay levels or expenditure levels.

- The examples of indirect taxes are sales tax, central excise duty, custom duty, recreational tax, etc.

- Excise duty: A percentage levied on manufacture, sale or use of locally produced goods such as tobacco, alcohol etc.

- Custom duty: A tax levied on

exportandimportof goods.

Agricultural Income

- Agriculture income is

exemptunder theIndian Income Tax Act 1961. This means that income earned from agricultural operations is not taxed. The reason for exemption of agriculture income from Central Taxation is that the Constitution gives exclusive power to make laws with respect to taxes on agricultural income to the State Legislature. - However, the Income-tax Act has laid down a method to indirectly tax such income. This method or concept may be called as the partial integration of agricultural income with non-agricultural income. It aims at taxing the non-agricultural income at higher rates of tax.

👉🏻 As per Income Tax Act income earned from any of the under given four sources meant Agricultural Income:

- Any rent received from land which is used for agricultural purpose.

- Any income derived from such land by agricultural operations including processing of agricultural produce, raised or received as rent in kind so as to render it fit for the market, or sale of such produce.

- Income attributable to a farm house

- Income earned from carrying nursery operations is also considered as agricultural income and hence exempt from income tax.

Canons of Taxation

Adam Smith’s was a pioneer in the field of taxation and made notable contributions popularly known as Canons of taxation.

- Canon of Equality: means the principle of justice, i.e., in accordance to “ability to pay”. It means the equality of sacrifice. The amount of the tax paid is to be in proportion to the respective abilities of the taxpayers. For example: Progressive taxation.

- Canon of Sacrifice: The principle states that tax amount should be in proportion to the respective abilities of the tax payer. The abilities represents the various income levels.

- Canon of Certainty: prescribes that the tax which each individual is bound to pay ought to be certain, and not arbitrary. The time of payment, the manner of payment, the quantity to be paid, ought to be clear and simple to the taxpayer. Uncertainty in taxation encourages insolence or corruption.

- Canon of Convenience: The tax is to be levied at the time or the manner in which it is most convenient for the taxpayers to pay their dues. For example, Cess has to be collected from the farmers after the principal crops are harvested and marketed.

- Canon of Economy: It means that the tax will be economical only when the cost of collection is small. Huge and unnecessary administrative costs will make the tax collection an extravagant task.

Other Canons of Taxation

- Fiscal Adequacy or Productivity: The State should meet its expenditure from the revenue raised from the people in the form of taxes. However, the government should not hamper the productive capacity by taxing the community heavily.

- Canon of Elasticity: The revenue should increase to cater the needs of the State. This is to ensure the government adequate financial resources to meet an emergency situation.

- Canon of Flexibility: It means that there should be no rigidity in the tax system so that it can be quickly adjusted to new conditions.

- Canon of Simplicity: This aims at tax which is simple, plain and intelligible to the common understanding. This canon is essential if corruption or oppression is to be avoided.

- Canon of Diversity: The tax should be a wise admixture of direct and indirect taxes. On the other hand, too great multiplicity will be bad and uneconomical.

- Social and Economic Objectives: This states that the social and economic objectives of a standard tax system viz., (i) Reduction of inequalities in the distribution of income and wealth, (ii) Accelerating economic growth and (iii) Price stability

- Canon of Neutrality: Taxation system should be used to control threats of economic instability and stagnation.

Goods and Service Tax

- Goods and Services Tax (GST) is an indirect tax (or consumption tax) used in India on the supply of goods and services.

- It is a comprehensive, multistage, destination based tax: comprehensive because it has subsumed almost all the indirect taxes except a few state taxes. Multi-staged as it is, the GST is imposed at every step in the production process, but is meant to be refunded to all parties in the various stages of production other than the final consumer and as a destination based tax, it is collected from point of consumption and not point of origin like previous taxes.

- Goods and services are divided into five different tax slabs for collection of tax - 0%, 5%, 12%, 18% and 28%. However, petroleum products, alcoholic drinks, and electricity are not taxed under GST and instead are taxed separately by the individual state governments, as per the previous tax system.

- There is a special rate of 0.25% on rough precious and semi-precious stones and 3% on gold. In addition a cess of 22% or other rates on top of 28% GST applies on few items like aerated drinks, luxury cars and tobacco products. Pre-GST, the statutory tax rate for most goods was about 26.5%, Post-GST, most goods are expected to be in the 18% tax range.

- The tax came into effect from 1 July

2017through the implementation of the 101 Amendment of the Constitution of India by the Indian government. The GST replaced existing multiple taxes levied by the central and state governments. - The tax rates, rules and regulations are governed by the GST Council which consists of the finance ministers of the central government and all the states. The GST is meant to replace a slew of indirect taxes with a federated tax and is therefore expected to reshape the country’s 2.4 trillion-dollar economy, but it’s implementation has received criticism. Positive outcomes of the GST includes the travel time in interstate movement, which dropped by 20%, because of disbanding of interstate check posts.

- Vegetables and produce from agriculture, including dairy, served fresh without any processing have been exempted from GST.

- The expenditure of the Government has to be met from the revenue that is accrued by the Government from various sources.

Sources of revenue

The functions of Government are very important and extensive which require heavy expenditure. Government has to undertake important functions like defense (internal and external), Social welfare, education, health, industry, agriculture. For all of these a huge amount of funds is required.

The major sources of revenue for the Government are in the form of Taxes and Prices while the minor sources are Fees, Special assessment, Escheat, Grants, gifts donations, tributes and indemnities.

Major Sources

- Tax: A compulsory contribution imposed on the public.

- Price: A price is the payment for a service of business character, for example, charges for …

Become Successful With AgriDots

Learn the essential skills for getting a seat in the Exam with

🦄 You are a pro member!

Only use this page if purchasing a gift or enterprise account

Plan

- Unlimited access to PRO courses

- Quizzes with hand-picked meme prizes

- Invite to private Discord chat

- Free Sticker emailed

Lifetime

- All PRO-tier benefits

- Single payment, lifetime access

- 4,200 bonus xp points

- Next Level

T-shirt shipped worldwide

Yo! You just found a 20% discount using 👉 EASTEREGG

High-quality fitted cotton shirt produced by Next Level Apparel