RRB SO AFO Scale 2

About IBPS, Eligibility, Vacancies, Level of Exam, About RRBs, Profile of RRB Scale 2 AFO, Salary, Allowances, Comparison to Public Sector Banks

About IBPS

- The Institute of Banking Personnel Selection (IBPS) is the organization responsible for conducting the RRB SO AFO (Agriculture Field Officer) examination.

- IBPS is an autonomous body established to assist public sector banks and financial institutions in the selection of personnel for various positions.

- It conducts various competitive examinations throughout the year to recruit eligible candidates for different levels of posts in the banking sector.

- Besides the RRB SO - AFO, IBPS also conducts exams for PO, Clerk, Specialist Officer (SO) in other streams, NABARD, FCI and more.

- IBPS conduct a online examinations for Common Recruitment Process for RRBs for recruitment of Group “A”- Officers (Scale-I, II & III) and Group “B”- Office Assistants (Multipurpose).

Eligibility of Scale 2 (AFO)

- Officer Scale-II post is the managerial post.

- A candidate can apply for only one post in officer’s cadre i.e. for Officer Scale-I or Scale-II or Scale III.

- Whereas, a candidate can apply for the Post of Office Assistants (Multipurpose) and can also apply for the Post of Officer.

Age

- Above 21 years

- Below 32 years

- Candidates should not have been born earlier than 03.06.1992 and later than 31.05.2003 (both dates inclusive)

Category Age Relaxation Scheduled Caste (SC) /Scheduled Tribe (ST) 5 years Other Backward Classes (OBC - Non-creamy layer) 3 years Persons With Benchmark Disability (PwBD) as defined under “The Rights of Persons With Disabilities Act, 2016” 10 years Ex-Servicemen commissioned officers including ECOs/ SSCOs with at least 5 years military service 5 years Persons affected by 1984 riots 5 years

Educational Qualification

- Bachelor’s degree in Agriculture/ Horticulture/Dairy/ Animal Husbandry/ Forestry/ Veterinary Science/ Agricultural Engineering/ Pisciculture from a recognized university or its equivalent with a minimum of 50% marks in aggregate.

- All the educational qualifications mentioned should be from a University/Institution/ Board recognised by Govt. of India/ approved by Govt. Regulatory Bodies and the result should have been declared on or before 27.06.2024.

- Proper document from Board / University for having declared the result on or before 27.06.2024 has to be submitted at the time of interview for the posts of Officers.

- Candidate should indicate the percentage obtained in Graduation calculated to the nearest two decimals in the online application. Where CGPA / OGPA is awarded, the same should be converted into percentage and indicated in online application. If called for interview, the candidate will have to produce a certificate issued by the appropriate authority inter alia stating that the norms of the University regarding conversion of grade into percentage and the percentage of marks scored by the candidate in terms of norms.

- The percentage marks shall be arrived at by dividing the total marks obtained by the candidate in all the subjects in all semester(s)/year(s) by aggregate maximum marks (in all the subjects irrespective of honours / optional / additional optional subject, if any) and multiplying by 100. This will be applicable for those Universities also where Class / Grade is decided on basis of Honours marks only.

Experience

- Two Years (in the relevant field) of post-qualification experience with valid proof.

- Following are possible relevant fields:

- IBPS AFO Scale I in any nationalised bank.

- As an officer in any private bank handling agriculture related business.

- Working in any pesticide, seed, fertilizer etc. company either private, cooperative or government.

- Private agriculture company experience.

- FPO related experience.

- State Government agriculture job experience like agriculture supervisor with graduation.

- Employment in roles that involve providing agricultural extension services, including training and advising farmers on best practices, crop management, soil health, and sustainable farming techniques.

- Employment in research institutions or universities where the work is related to agriculture, agronomy, plant breeding, soil science, or any other field relevant to agricultural development.

- Young Professionals in Various Universities Projects

- Work on contact basis with government agencies.

- Worked in Private companies showing their company registration no. on experience letter.

Language

- Candidate should know the regional language of their preferred RRB.

- There are total

42Participating Regional Rural Banks (RRBs)

| Name of RRB | Present Head Office | State / UT | Desired Local Language Proficiency |

|---|---|---|---|

| Baroda Rajasthan Kshetriya Gramin Bank | Ajmer | Rajasthan | Hindi |

| Rajasthan Marudhara Gramin Bank | Jodhpur | Rajasthan | Hindi |

| Himachal Pradesh Gramin Bank | Mandi | Himachal Pradesh | Hindi |

| Aryavart Bank | Lucknow | Uttar Pradesh | Hindi |

| Baroda U.P. Bank | Gorakhpur | Uttar Pradesh | Hindi, Urdu, Sanskrit |

| Prathama U.P. Gramin Bank | Moradabad | Uttar Pradesh | Hindi |

| Sarva Haryana Gramin Bank | Rohtak | Haryana | Hindi |

| Madhya Pradesh Gramin Bank | Indore | Madhya Pradesh | Hindi |

| Madhyanchal Gramin Bank | Sagar | Madhya Pradesh | Hindi |

| Ellaquai Dehati Bank | Srinagar | Jammu & Kashmir | Dogri, Kashmiri, Punjabi, Urdu, Gojri, Pahari, Ladakhi, Balti (Palli), Dardi, Hindi |

| J & K Grameen Bank | Jammu | Jammu & Kashmir | Dogri, Kashmiri, Pahari, Gojri, Punjabi, Ladakhi, Balti (Palli), Dardi, Urdu, Hindi |

| Chhattisgarh Rajya Gramin Bank | Raipur | Chhattisgarh | Hindi |

| Dakshin Bihar Gramin Bank | Patna | Bihar | Hindi |

| Uttar Bihar Gramin Bank | Muzaffarpur | Bihar | Hindi |

| Jharkhand Rajya Gramin Bank | Ranchi | Jharkhand | Hindi |

| Punjab Gramin Bank | Kapurthala | Punjab | Punjabi |

| Arunachal Pradesh Rural Bank | Naharlagun (Papumpare) | Arunachal Pradesh | English |

| Nagaland Rural Bank | Kohima | Nagaland | English |

| Bangiya Gramin Vikash Bank | Murshidabad | West Bengal | Bengali |

| Assam Gramin Vikash Bank | Guwahati | Assam | Assamese, Bengali, Bodo |

| Paschim Banga Gramin Bank | Howrah | West Bengal | Bengali |

| Uttarbanga Kshetriya Gramin Bank | Coochbehar | West Bengal | Bengali, Nepali |

| Vidharbha Konkan Gramin Bank | Nagpur | Maharashtra | Marathi |

| Andhra Pradesh Grameena Vikas Bank | Warangal | Telangana | Telugu |

| Andhra Pragathi Grameena Bank | Kadapa | Andhra Pradesh | Telugu |

| Baroda Gujarat Gramin Bank | Vadodara | Gujarat | Gujarati |

| Chaitanya Godavari Grameena Bank | Guntur | Andhra Pradesh | Telugu |

| Karnataka Gramin Bank | Bellary | Karnataka | Kannada |

| Karnataka Vikas Grameena Bank | Dharwad | Karnataka | Kannada |

| Kerala Gramin Bank | Mallapuram | Kerala | Malayalam |

| Maharashtra Gramin Bank | Aurangabad | Maharashtra | Marathi |

| Manipur Rural Bank | Imphal | Manipur | Manipuri |

| Meghalaya Rural Bank | Shillong | Meghalaya | Khasi, Garo |

| Mizoram Rural Bank | Aizawl | Mizoram | Mizo |

| Odisha Gramya Bank | Bhubaneshwar | Odisha | Odia |

| Puduvai Bharathiar Grama Bank | Puducherry | Puducherry | Tamil, Malayalam, Telugu |

| Saptagiri Grameena Bank | Chittor | Andhra Pradesh | Telugu |

| Saurashtra Gramin Bank | Rajkot | Gujarat | Gujarati |

| Tamil Nadu Grama Bank | Salem | Tamil Nadu | Tamil |

| Telangana Grameena Bank | Hyderabad | Telangana | Telugu, Urdu |

| Tripura Gramin Bank | Agartala | Tripura | Bengali, Kokborak |

| Utkal Grameen Bank | Bolangir | Odisha | Odia |

Credit History

- The candidate applying shall ensure that, they maintain a healthy Credit history at the time of joining of RRBs.

- The minimum credit score will be as per the policy of participating RRBs (more than 650 out of 900), amended from time to time.

- Allotted RRBs reserve the right to disallow the candidate who does not meet the Credit History/ Score criteria of the RRB.

Vacancies

- IBPS, has released notifications for the recruitment of Specialist Officers, including Agriculture Field Officers (AFO), on a regular basis since 2018. While the exact number of vacancies fluctuates each year, there has been a consistent pattern of recruitment for this post.

- The number of vacancies for AFO posts can vary significantly from year to year depending on the requirements of the participating RRBs.

- For the most accurate and up-to-date information on vacancies, always refer to the official notifications released by IBPS.

Level of Exam

- The exam requires in-depth knowledge of agriculture and allied subjects, which can be challenging for those without a strong agricultural background.

- Given the limited number of vacancies and a large pool of applicants, the competition is quite intense.

- The exam comprises both general aptitude and subject-specific questions, demanding a well-rounded preparation.

- However, with focused preparation and a clear understanding of the exam pattern, the level of difficulty can be managed effectively.

About RRBs

- Government holding in RRBs is as follows:

Type Holding Percentage Central Government 50% Sponsoring Bank 35% State Govenment 15% - As you can see that majority of share (85%) is held by government. Rest by sponsoring bank which in have more than 50% government holding.

- Therefore it could be said that RRBs are more government than rest of the public sector banks (PSBs). Means you will have more job security in RRBs.

Profile of RRB Scale 2 AFO

- You will be posted under scale III or in regional office to process agricultural loans.

- Your main focus will be to increase agricultural advance and disburse or help branches to disburse agriculture loans.

- You have to also look after NPA management of the branch.

- Work pressure will be constant as only a few specilist are recruited by the RRBs.

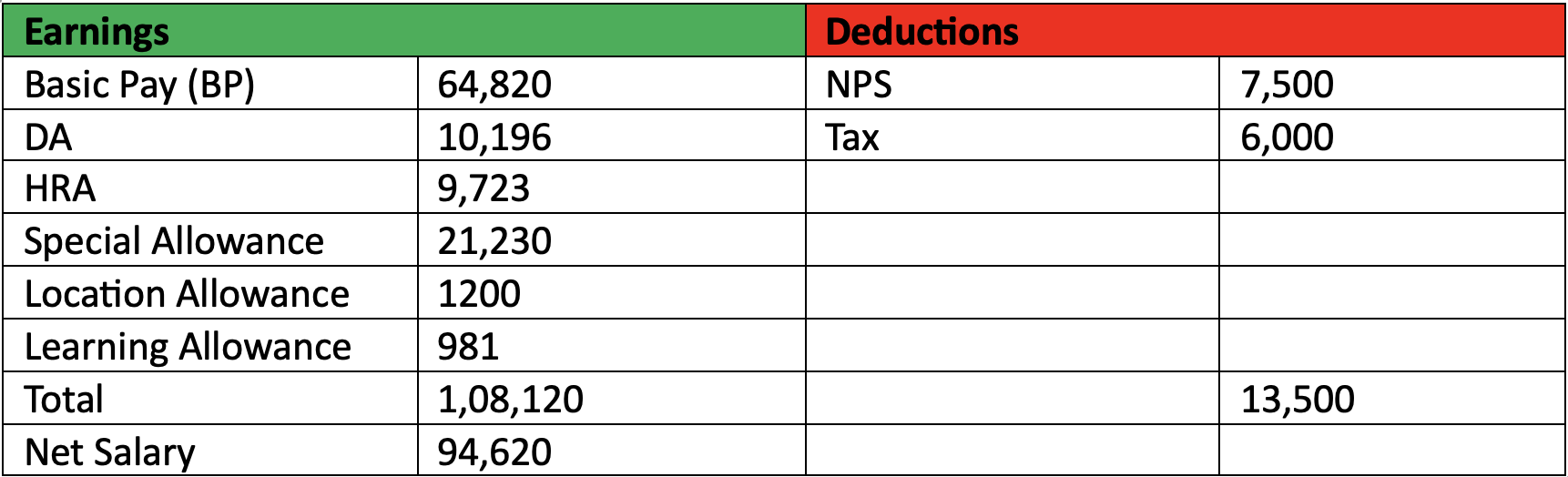

Salary

- If you have done JAIB and CAIB certification, then the gross will be Rs. 1,15,664/- and net salary will be Rs. 1,01,271/-.

Allowances

- Petrol: 20 to 30 Liters per month

- Newspaper: 150 to 200 per month

- Entertainment Allowance: 4000/- per quarter

- Medical Allowances: 10,300/- per annum

- PLI: As per bank profit.

- LFC: in 4 years

- Medical: 4 lakh insurance for self and dependents.

- Most of RRBs don’t yet start lease accommodation facility for the staff. A few have started providing lease facility.

Comparison to Public Sector Banks

- Less pressure than PSBs.

- Free at maximum 5:30PM.

- No login day or disbarment pressure from management.

- No harassment or abusing from seniors.

- Can prepare for other exams easily. Persue your hobbies.

- Posted in only home state or where bank HQ is located.

- Rural people will respect your designation.

- More government holding, so more job security.

- In future, government has no planning for privatization, but government can merge these banks.

About IBPS

- The Institute of Banking Personnel Selection (IBPS) is the organization responsible for conducting the RRB SO AFO (Agriculture Field Officer) examination.

- IBPS is an autonomous body established to assist public sector banks and financial institutions in the selection of personnel for various positions.

- It conducts various competitive examinations throughout the year to recruit eligible candidates for different levels of posts in the banking sector.

- Besides the RRB SO - AFO, IBPS also conducts exams for PO, Clerk, Specialist Officer (SO) in other …